As the measures taken to slow the spread of the coronavirus (COVID-19) are beginning to take a toll on the economy through a reduction in activity in travel, dining, entertainment and other consumer spending categories, the U.S. government has been formulating ways to help stem the economic impact on both consumers and businesses.

Two smaller bills have already been passed to cover spending for response to COVID-19 through the government health agencies, testing, protection for healthcare, family sick leave, and other immediate matters. The larger economic stimulus package that has been discussed, initially at $1 trillion and possibly higher, is still being worked on in Congress. Unfortunately, we will likely see much political wrangling before a final bill gets approved. We expect that to pass in some form early this week.

The Federal Reserve continues to take actions to stabilize the financial markets. The Fed is providing support for the bond markets, money markets, and a large range of other financial assets, as well as the banking system.

While strong measures are being taken to minimize the economic impact of the crisis, news flow regarding COVID-19 is likely to have a bigger impact in the minds of consumers and investors over the near-term. A slowing in the rate of spread of the virus would improve the national psyche and restore some confidence.

In our Dissecting Headlines section, we look at Initial Unemployment Claims and why we think they are an important metric to monitor for the next several weeks.

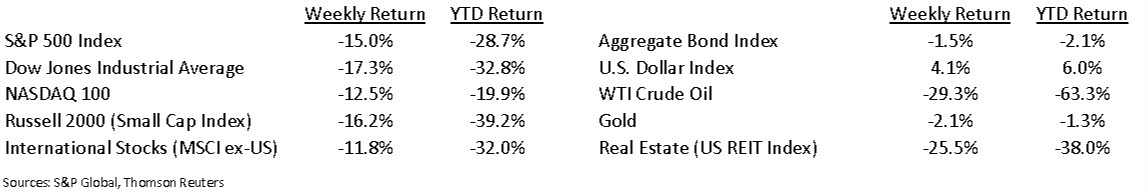

Financial Market Update

Dissecting Headlines: Initial Unemployment Claims

The most concerning economic impact of the COVID-19 response is rising unemployment in hard hit industries to include travel, lodging, restaurants, and other consumer-facing industries. The best way to gauge the impact on a weekly basis is to monitor initial unemployment claims. The initial claims data is released each Thursday by the Department of Labor. The data is collected at local unemployment offices and flows up to the Department of Labor.

For the week ending March 14th, initial claims increased to 281,000 from 211,000 the week prior. We expect this number to climb significantly over the next few weeks as the announced layoffs move through the system. As the data can be volatile week-to-week, a four-week moving average is also reported. For the week ending March 14th, the moving average increased to 232,250 from 214,000 the prior week.

As individuals remain unemployed they are reported as continuing claims. After the initial claims peak, it will be important to monitor an eventual decrease in continuing claims so we can measure the pace of individuals returning to work.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint March 23, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.