As markets continue to experience volatility amid economic concerns from the spread of the coronavirus (COVID-19), we want to look at counterbalancing effects we are seeing to stabilize the economy.

We mentioned last week we believe the economy should self-correct over time. While 10-year Treasury yields have fallen, the Federal Reserve also made the decision to lower short-term interest rates by 0.50% last week to a target rate of 1.00% to 1.25%. This makes short-term borrowing less expensive between financial institutions, as well as for corporations and individuals. Home mortgage rates had already been falling along with longer dated interest rates. The lower cost of borrowing allows companies and consumers to lower their interest expense, which can provide additional cash flow.

Energy prices have also fallen significantly and the effort by OPEC+ members to agree on a production cut failed resulting in even lower energy prices. Lower energy input costs should eventually be seen at the gasoline pump for consumers as well as reduce costs through manufacturing and transportation supply chains. Lower energy prices typically result in a boost to consumer spending as money saved at the pump is available for other discretionary purchases. In our Dissecting Headlines section, we look at OPEC+ and why the effort to stem oil price declines didn’t work.

Stability, both in news flow and the financial markets, should eventually restore confidence in consumers and investors.

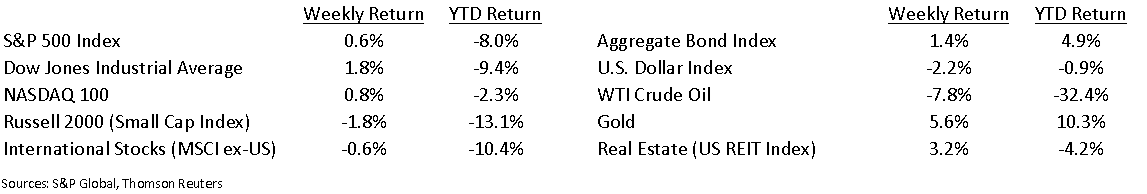

Financial Market Update

Dissecting Headlines: OPEC+

OPEC is the Organization of Petroleum Exporting Countries. It is a cartel of 13 nations, mainly from the Middle East and Africa, that cooperate to set targets for energy production and prices. The cartel controls more than 40% of global oil production. Adding in Russia and a few other countries creates OPEC+, a broader alliance controlling at least half the world’s oil.

Economic slowing has caused demand for oil to decline. The normal reaction is for OPEC+ to reduce production to keep oil supply balanced with demand. While sometimes a tenuous negotiation, the group usually comes to an agreement. Last week Russia balked at the production cut proposed by Saudi Arabia. The result was Saudi Arabia deciding to lower contract prices and increase production, potentially in a move to punish Russia for not cooperating. This breakdown in the OPEC+ alliance should lower energy prices resulting in the potential boost to consumer spending as mentioned above.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint March 9, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.