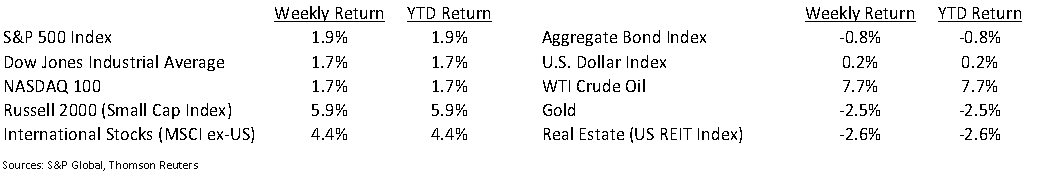

The stock market shrugged off a down first trading day of the year and finished the first week of 2021 with gains. For the week, the Dow Jones Industrial Average was +1.7%, the S&P 500 Index was +1.9%, and the NASDAQ 100 Index was +1.7%. Oil also continued its year-end rally and opened 2021 with a 7.7% increase.

Many of the COVID-recovery economic data we watched through 2020 are still on the radar to monitor here in early 2021. Initial unemployment claims during the week of January 2nd decreased to 787,000 versus 790,000 the previous week. Continuing claims for the week of December 26th were 5.072 million versus 5.198 million the week prior. Continued improvement in employment is one of the major factors required to sustain economic recovery in 2021.

The Federal Reserve is scheduled to release its Summary of Commentary on Current Economic Conditions (aka the “Beige Book”) for January this week. That should provide access to data and commentary from each of the Fed Regions.

Fourth quarter earnings reports kick off this week with ten companies in the S&P 500 Index scheduled to report earnings. Fourth quarter 2020 earnings are expected to decline 9.8% year-over-year on a revenue decline of 1.3%. Full-year 2020 earnings are expected to decline 15.1% on a revenue decline of 3.1%. Full-year 2021 earnings are expected to rise 23.6% on revenue growth of 8.3%.

In our Dissecting Headlines section, we look at the pick up in U.S. rail traffic.

Financial Market Update

Dissecting Headlines: U.S. Rail Traffic

U.S. rail traffic for December was +4.4% higher than December 2019. If we think back to before the pandemic, some rail traffic was weaker due to the US-China tariffs in 2019 and early 2020. Still, December’s momentum shows a strong recovery in this key sector of the economy. Total 2020 U.S. rail traffic was down 7.2% year-over-year with commodity carloads down 12.9% and Intermodal carloads down 1.8%. Coal saw the largest volume decline for 2020 (-24.6%) and Grain saw the only year-over-year gain (+4.6%).

Rail traffic is reported weekly and gives us a real time look into multiple parts of the economy. There are ten commodity categories plus Intermodal. The commodity, or “unfinished goods”, categories are Chemicals, Coal, Farm Products and Food (excluding Grain), Forest Products, Grain, Metallic Ores and Metals, Motor Vehicles and Parts, Nonmetallic Minerals, Petroleum, and Other. Intermodal, or “intermediate and finished goods”, represent freight loaded into containers and transported via rail. Much of this originates from containers being cross-docked from shipping ports to rail.

__________________________________________________________

Want a printable version of this report? Click here: NovaPoint January 11, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.