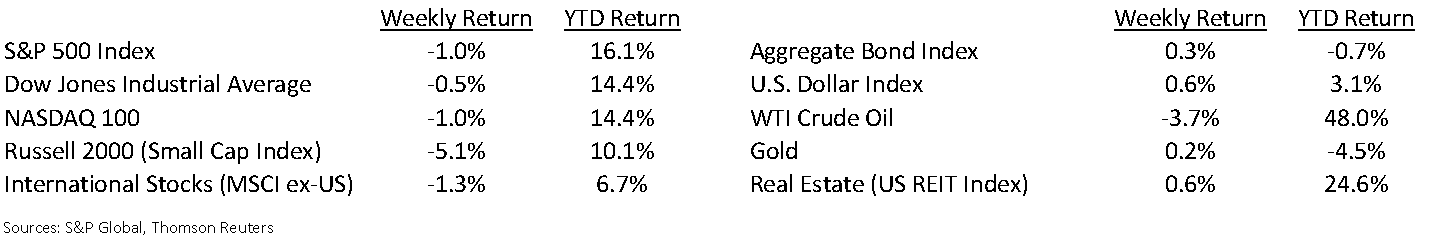

Despite good earnings from the major banks and some other companies in the first week of second quarter earnings reporting, the market averages struggled in the back half of the week. Continued presence of inflationary pressures and unknown potential impact of the COVID Delta variant led investor concerns. The S&P 500 Index closed the week –1.0%, the NASDAQ –1.0% and the Dow –0.5%. The U.S. 10-year Treasury bond yield decreased to 1.300% at Friday’s close versus 1.361% the previous week.

The second quarter earnings reporting season continues to ramp up this week with 81 companies in the S&P 500 Index scheduled to report earnings. The current expectation is for S&P 500 earnings growth of 72.0% year over year, an increase from the expectation of 65.8% year over year growth from last week.

Initial unemployment claims for the week of July 10th decreased to 360,000 versus the previous week at 386,000. Continuing claims for July 3rd were 3.241 million versus 3.367 million the week prior. The Federal Reserve continues to point to employment as its primary reason for keeping monetary policy supportive.

In our Dissecting Headlines section, we take a look at current monetary policy.

Financial Market Update

Dissecting Headlines: Monetary Policy

Federal Reserve Chairman Jerome Powell presented his Semiannual Monetary Policy Report to Congress last week. He acknowledged that the economy has been recovering from the COVID-19 pandemic. This economic growth has elevated price levels in the economy as supply has not yet caught up with increased demand from consumers and producers. The Federal Reserve is content to live with these inflationary pressures and plans to keep monetary policy accommodative until the labor market returns to pre-pandemic levels.

Monetary policy is what the Federal Reserve does to influence the amount of money and credit in the economy. The two major tools are interest rate policy and open market operations. When the pandemic hit the economy in the first quarter of 2020, the Federal Reserve cut its short-term interest rate target to near zero. This influences expansion of credit to help the economy. It also began an aggressive bond buying program that help put liquidity, or the supply of money, into the economy. Two of the Federal Reserve’s key mandates are price stability (managing inflation) and employment. Currently, the Federal Reserve is content to allow prices to remain elevated while it works on returning the economy to a stronger employment situation.

We have been monitoring the employment situation every week (see above) because we think that is the key element to anticipating eventual changes in monetary policy.

________________________________________

Want a printable version of this report? Click here: NovaPoint July 19, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.