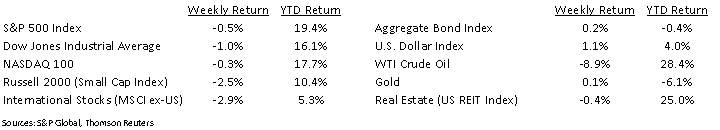

A geopolitical crisis in Afghanistan and hints from the Federal Reserve that it could soon begin tapering monthly bond purchases combined to lead the equity markets to a negative week. The S&P 500 Index closed the week –0.5%, the NASDAQ –0.3% and the Dow –1.0%. The U.S. 10-year Treasury bond yield decreased to 1.260% at Friday’s close versus 1.297% the previous week.

We are pushing into the final stages of the second quarter earnings reports. In the S&P 500 Index, 476 companies have already reported second quarter earnings. The current expectation is for S&P 500 earnings growth of 94.7% year-over-year versus a 93.8% forecast last week. This week, 13 companies in the S&P 500 are scheduled to report earnings. Looking ahead, the current forecast for third quarter earnings for the S&P 500 Index is +29.7% year-over-year and a fourth quarter earnings forecast of +21.6% year-over-year. This ramp down in growth reflects the impact of year-over-year comparisons versus the second half of 2020 as the economy was in its early rebound from the COVID-induced recession.

Initial unemployment claims for the week of August 14th decreased to 348,000 versus the previous week at 377,000. Continuing claims for August 7th were 2.820 million versus 2.899 million the week prior. Continued improvement in employment is a key element to the Federal Reserve’s eventual change in monetary policy.

In our Dissecting Headlines section, we look at the Fed Chairman’s upcoming speech at the Jackson Hole Economic Symposium.

Financial Market Update

Dissecting Headlines: Jackson Hole Economic Symposium

The Jackson Hole Economic Symposium is an annual event sponsored by the Federal Reserve Bank of Kansas City. This year’s conference could be significant when Fed Chairman Jerome Powell speaks on Friday on the U.S. economic outlook. The Chairman’s remarks will be scrutinized for signals regarding changes in monetary policy, particularly about timing of a taper of the Fed’s monthly bond purchases.

The minutes of the July Federal Open Market Committee (FOMC) meeting were released last week. The discussion showed that several committee members felt that “provided that the economy were to evolve broadly as they anticipated, they judged that it could be appropriate to start reducing the pace of asset purchases this year”. A confirmation of both economic conditions and the Fed’s willingness to start tapering purchases could be a key component of Powell’s speech.

The Fed leapt into action at the onset of COVID in 2020 by reducing short-term interest rates to zero and purchasing bonds to inject liquidity into the financial system. Given the economic recovery from COVID, the Fed will eventually need to reduce this overly accommodative monetary policy. Tapering monthly bond purchases would be a first step in this policy transition.

A policy shift to raise the Fed Funds target rate still is not likely until well into 2022, but the next update for that would be the release of the quarterly summary of economic projections at the conclusion of the September FOMC meeting.

________________________________________

Want a printable version of this report? Click here: NovaPoint August 23, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.