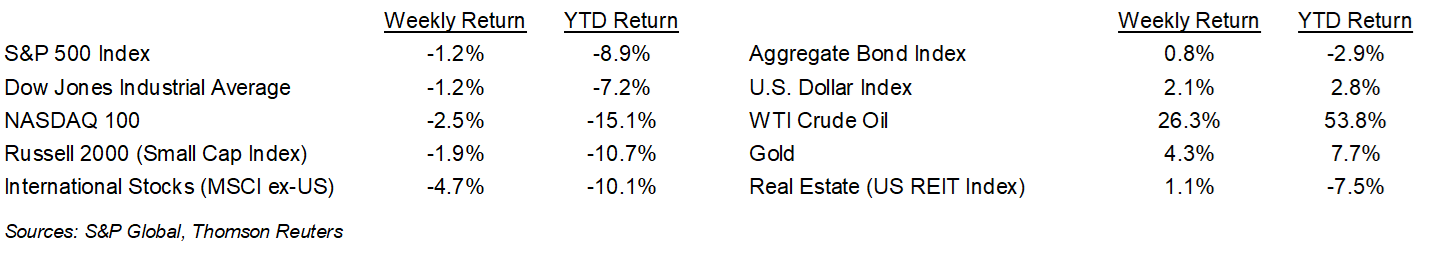

Russia’s continued advance into Ukraine caused a market decline for the week, despite a strong employment report for February and comments from Fed Chair Jerome Powell that he supports a 0.25% increase in the Fed funds rate this month rather than 0.50%. The S&P 500 Index ended the week -1.2%, the Dow was -1.2%, and the NASDAQ was -2.5%. The U.S. 10-year Treasury bond yield decreased to 1.738% at Friday’s close versus 1.970% the previous week on a flight to quality due to geopolitical uncertainty.

The February employment report showed 678,000 new jobs created for the month versus an expectation for 425,000. The unemployment rate fell to 3.8%. With inflation above trend and employment levels acceptable, the Fed should begin raising the Fed funds rate at the conclusion of the March 16th meeting. Fed Chair Powell said on Wednesday he will back a 0.25% rate increase. Powell said the Fed needs to balance fighting high U.S. inflation against the complex new risks of a European land war.

With 493 companies in the S&P 500 Index having reported earnings, the fourth quarter earnings season is almost complete. The current consensus forecast is for the fourth quarter is for earnings growth of 32.0% on 15.1% revenue growth versus an expectation of 22.4% earnings growth on 12.1% revenue growth at the start of the earnings season. During the coming week, three companies in the S&P 500 Index are scheduled to report earnings. Looking ahead, the early read for the first quarter is 6.2% earnings growth on 10.7% revenue growth.

In our Dissecting Headlines section, we look at the actions underway against the Russian economy.

Financial Market Update

Dissecting Headlines: Russian Economy

Several countries and multi-national companies are attempting to reduce Russia’s ability to wage war in Ukraine by shutting down its economy. Western countries froze Russia’s central bank reserves, Russian banks have been shut off from most of the world banking system, and its citizens are being restricted from many payments networks to include Visa, MasterCard, and American Express. Other companies are shutting down operations in Russia or refusing to ship products or provide services to Russia. Russia is the world’s 11th largest economy, based on nominal GDP in dollars. The rouble has lost 33% of its value since Russia started massing troops on Ukraine’s border.

One benefit to Russia’s treasury has been oil and gas exports as prices have increased since the COVID-era lows. Regarding oil production, Russia ranks second in the world behind the United States. Revenue from oil and gas funded a third of Russia’s government budget in 2021. There have been calls for the U.S. to ban Russian oil imports. The United States imported more than 20.4 million barrels of crude and refined products a month on average in 2021 from Russia, about 8% of U.S. liquid fuel imports, according to the Energy Information Administration (EIA). About half the product goes to the West Coast of the U.S., another quarter to the East Coast, and the remainder heads to the Gulf Coast for refining.

While oil prices have been rising even prior to the Russian invasion of Ukraine, the U.S. rig count is still not back to pre-COVID levels. As of March 4, 2022, the U.S. drilling rig count is 650. At the start of January 2020, the U.S. rig count was 796. The rig bottomed at 244 in mid-August 2020.

The cost of forcing Russia to abandon its campaign in Ukraine may be higher energy prices and a decline in global GDP, at least in the near-term.

________________________________________

Want a printable version of this report? Click here: NovaPoint March 7, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.