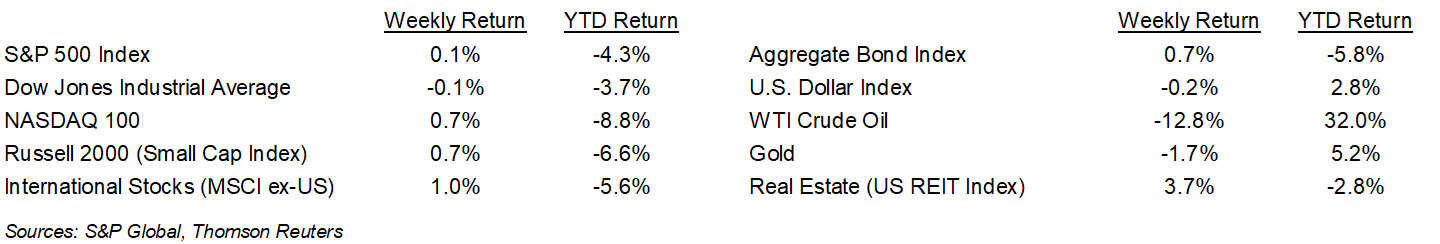

This week ended the first negative quarter for the equity markets since the onset of COVID which caused a decline in the first quarter of 2020. The S&P 500 Index has produced three consecutive positive weekly returns since the quarter lows in early March. The S&P 500 ended the week +0.1%, the Dow was -0.1%, and the NASDAQ was +0.7%. The ten-year U.S. Treasury note yield declined to 2.390% at Friday’s close versus 2.488% the previous week.

Risks that caused the negative quarterly returns, including inflation, energy prices, monetary policy tightening, and the Russia/Ukraine conflict, still exist. As markets and investors tend to do, those risks get absorbed into the valuation framework and the current trade focuses on the increments of positive and negative change. We will see the degree that these risks have impacted the quarterly performance and forward outlook for individual companies starting the week of April 11th, as the first quarter earnings reporting season begins. The current consensus for the first quarter is 6.4% year-over-year earnings growth on 10.9% revenue growth.

In our Dissecting Headlines section, we look at the recent yield curve inversion.

Financial Market Update

Dissecting Headlines: Yield Curve Inversion

A yield curve is a line that plots yields, or interest rates, of bonds of the same credit quality across their calendar maturities. The most closely watched yield curve is that for U.S. Treasury debt as it is used as a benchmark for pricing debt of various credit qualities across the same time continuum. The yield curve is generally upward sloping since investors normally require higher yields for lending money for a longer period of time. When the yield on shorter term maturities is higher than that of longer term maturities, the yield curve becomes inverted.

The difference in yields between the two-year and ten-year U.S. treasury securities is the common data point used to determine if the yield curve is inverted. Last week, the two-year U.S. treasury note closed the week at 2.462% and ten-year U.S. treasury note closed the week at 2.390%.

While an inverted yield curve has often preceded recessions in recent decades, it does not cause them. Bond investors expectations, reflected in the price of the ten-year, are where they view the longer-term yields should be. In the current inversion, the two-year has quickly repriced to a level closer to where the Federal Reserve has indicated the Fed funds rate could be in 6 to 18 months, so the two-year yield rising caused the inversion rather the ten-year yield falling rapidly. Yields on both maturities have moved up year-to-date with the two-year yield moving from 0.734% to 2.462% and the ten-year yield moving from 1.512% to 2.390%. The end of the Federal Reserve’s monthly bond purchase program and balance sheet wind down could eventually cause a more parallel upward shift.

While the Federal Reserve has outlined a systematic, and potentially aggressive, plan to raise short-term interest rates to fight inflation, the objective is not to push the economy into a recession. With only a single 0.25% increase so far in the Fed funds target rate, the Federal Reserve has multiple meetings to analyze the impact of its monetary policy tightening on the economy and make potential adjustments if necessary.

________________________________________

Want a printable version of this report? Click here: NovaPoint April 4, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.