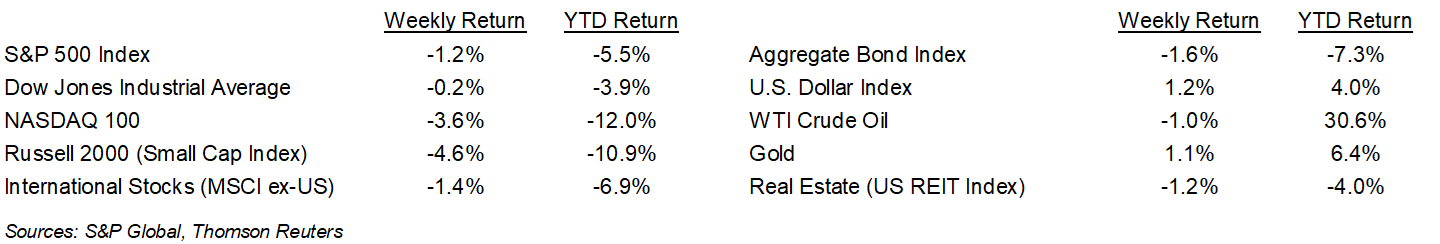

The Federal Reserve’s plan to aggressively stem inflation pressured equity markets last week. The S&P 500 ended the week -1.2%, the Dow was -0.2%, and the NASDAQ was -3.6%. The 10-year U.S. Treasury note yield increased to 2.704% at Friday’s close versus 2.390% the previous week. The rise in the 10-year Treasury yield returned the yield curve to a more normal shape following last week’s inversion of 2-year versus 10-year yields. Investors quickly re-priced the longer end of the yield curve following the release of the minutes of the Fed’s March meeting which indicated the start of a balance sheet reduction could begin as early as next month.

The first quarter earnings reporting period begins this week. We should hear from most of the large banks and that should give insight to how movements in interest rates and the conflict in Eastern Europe are impacting the financial sector. In all, 14 companies in the S&P 500 Index are scheduled to report earnings this week. The current consensus for the first quarter is 6.1% earnings growth on 10.9% revenue growth.

In our Dissecting Headlines section, we look at the Fed’s Balance Sheet.

Financial Market Update

Dissecting Headlines: Fed Balance Sheet

The Federal Reserve’s balance sheet has assets and liabilities similar to any other bank balance sheet. The Fed can increase or decrease the size of its balance sheet as a tool to meet its core mandates of full employment and price stability, as well as maintaining the stability of the financial system.

Prior to the economic crisis sparked by the COVID pandemic, the Fed’s balance sheet size was just over $4 trillion. The Fed acted aggressively to backstop the financial system by purchasing U.S. Treasury and mortgage-backed securities. This helped lower interest rates, create financial liquidity for institutions and individuals, and allowed the government to put multiple financial support mechanisms in place to ease the burden brought on by the pandemic-driven business closures and social restrictions.

Now that the pandemic has eased the labor market has returned to near pre-pandemic levels, the Fed has been faced with fighting high levels of price inflation across most of the economy. The Fed has already stopped the bond purchases and has begun raising the Fed funds target rate to begin normalizing monetary policy. A third piece of this is reducing the size of the Fed’s balance sheet which increased to just under $9 trillion over the course of the pandemic. Through the open market operations conducted by the Federal Reserve Bank of New York, the Fed will begin selling up to $95 billion of fixed income securities per month beginning as early as next month. The Fed currently holds $5.8 trillion of U.S. Treasury securities and will sell up to $60 billion per month. The Fed also hold $2.7 trillion of mortgage-backed securities and will sell up to $35 billion per month.

The combination of higher short-term interest rates initiated by raising the Fed fund target rate and the open market sales of longer-term government and mortgage-backed bonds should raise interest rates across the yield curve in an effort to reduce liquidity and stem the rise in prices. The reduction in the Fed’s balance sheet is also a prudent action to let investors absorb the government debt securities and allow the Fed to save balance sheet capacity for the future.

________________________________________

Want a printable version of this report? Click here: NovaPoint April 11, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.