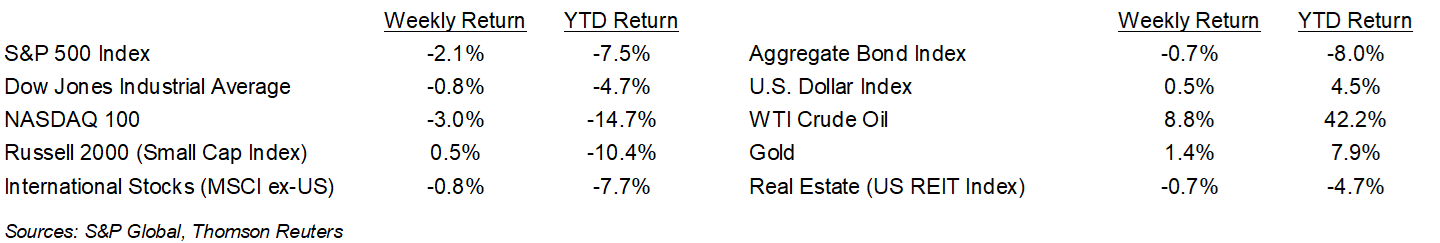

A mixed start to first quarter earnings reporting and two key inflation reports sent equity markets lower last week. The S&P 500 Index ended the week -2.1%, the Dow was -0.8%, and the NASDAQ was -3.0%. The 10-year U.S. Treasury note yield increased to 2.828% at Thursday’s close versus 2.704% the previous week. The steady rise in Treasury yields has also pushed 30-year mortgage rates above 5% for the first time since 2018.

The March Consumer Price Index report showed retail prices +8.5% year-over-year and the March Producer Price Index report showed wholesale prices +11.2% year-over-year. Higher energy prices were key contributors in both reports.

The first quarter earnings reporting period accelerates this week with 69 companies in the S&P 500 Index scheduled to report earnings. The current consensus for the first quarter is 6.3% earnings growth on 10.9% revenue growth versus 6.1% earnings growth on 10.9% revenue growth at the start of the earnings season.

In our Dissecting Headlines section, we look at the recent rise in mortgage rates.

Financial Market Update

Dissecting Headlines: Mortgage Rates

One benefit to homeowners during COVID was a sharp drop in mortgage rates. This made home ownership more affordable for first-time buyers and those who wanted to move into larger houses to accommodate working from home. It also made refinancing of higher interest mortgage possible, either to lower monthly payments, shorten the term of the mortgage, or provide cash-out financing. For homeowners today, that benefit has now disappeared as 30-year mortgage rates have risen above 5% for the first time since 2018.

While several economic inputs go into determining mortgage rates, one of the key factors is the 10-year Treasury yield. When the Federal Reserve recently indicated it would start reducing its balance sheet, yields on the 10-year Treasury bond increased in anticipation of the market needing to absorb the sale of up to $95 billion in Treasury and mortgage bonds each month. This also sent rates on mortgages higher.

The increase in mortgage rates, even before the rise above 5%, has been slowing application activity. According to data from the Mortgage Bankers Association, mortgage applications have declined on a year-over-year basis for the past five weeks and 10 out of the 14 weeks so far in 2022.

A shortage of homes for sale in many markets has kept real estate prices high. The National Association of Realtors February Existing Home Sales report showed only a 1.7 month supply of homes available versus a more normal supply of 4 to 5 months on average. Median existing home prices were 15.0% higher year-over-year in February, representing the 120th consecutive month of year-over-year gains. An increase in mortgage rates without a corresponding decline in home prices can create an affordability issue for many homebuyers and is not likely sustainable.

The next data points to watch are the Mortgage Bankers Association’s Applications Index, which is released each Wednesday, showing mortgage application activity, and the National Association of Realtors’ Existing Home Sales report for March, also scheduled for Wednesday, showing home purchase activity and pricing.

________________________________________

Want a printable version of this report? Click here: NovaPoint April 18, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.