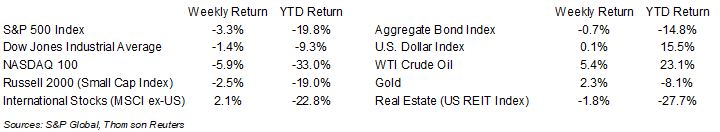

Stocks declined last week as the Federal Reserve did not indicate it was ready to cease its interest rate increase cycle. For the week, the S&P 500 was -3.3%, the Dow was -1.4%, and the NASDAQ was -5.9%. The 10-year U.S. Treasury note yield increased to 4.158% at Friday’s close versus 4.010% the previous week.

The Federal Open Market Committee (FOMC) raised the Fed fund target range by 0.75% to a 3.25% to 4.00% range. The FOMC is not done raising rates but is likely to begin a more moderate pace of increases soon. The equity markets had a relief rally on Friday after the October employment report showed 216,000 jobs were created for the month and the unemployment rate increased to 3.7%. The labor market is straddling an interesting line where too much good news likely means more interest rate increases, but too much bad news would be bad for consumer spending and GDP growth.

We are on the downslope of third quarter earnings reporting with 428 companies in the S&P 500 Index complete. This week, 31 companies in the S&P 500 Index are scheduled to report earnings. The current consensus expectation for the third quarter is 4.3% earnings growth on 11.0% revenue growth. For CY2022 earnings growth is currently forecast at 6.0% on 11.3% revenue growth.

Major data points this week are the October Consumer Price Index (CPI) report scheduled for Thursday and the results of the midterm elections which should start rolling in very late on Tuesday night.

In our Dissecting Headlines section, we look at the upcoming midterm elections and its historical impact on equity markets.

Financial Market Update

Dissecting Headlines: Election Impact

Heading into the U.S. midterm elections, the polls are currently predicting the Republican Party to take control of the House of Representatives. The race for control of the U.S. Senate is much closer with some polls predicting the Democratic Party retains control (outright or through a tie) and some predicting the Republicans can take control.

If the election plays out consistent with the current polling, we will wind up with a Democrat in the White House, since President Biden is not up for reelection, and either Republican control of both legislative chambers or at least one. Historically, this should be a positive for the stock market.

In the modern era, the average annual return of the S&P 500 Index with a Democrat in the White House and Republican control of both chambers of Congress is 13.0% and if a Democrat is in the White House and Congress is split the average annual return is 13.6%.

Having one party control the government (White House and Congress) has historically produced good returns as well with an average annual return of 12.9% for the S&P 500 Index when Republicans control the government and 9.8% when Democrats control the government.

The worst relative returns are produced when a Republican is in the White House and Democrats control both chambers of Congress for a 4.9% average annual return, or when the Democrats control at least one chamber for a 5.2% return.

While this may be partially simple correlation, we can attribute some causation given the impact of government policy on the economy and, subsequently, on stock market returns.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly November 7, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.