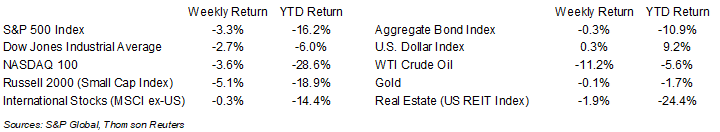

Equity markets retrenched last week after the November Producer Price Index (PPI) showed inflation to be stickier than anticipated. The S&P 500 was -3.3% for the week, the Dow was -2.7%, and the NASDAQ was -3.6%. The 10-year U.S. Treasury note yield increased to 3.567% at Friday’s close versus 3.503% the previous week.

The November PPI was +0.3% month-to-month and core PPI was also +0.3% month-to-month. The month-to-month change was slightly above the +0.2% expectation for PPI and core PPI. Year-over-year, PPI was +7.4% and core PPI was +4.9%. This is a continued downward trend from the +8.1% PPI and +5.4% core PPI seen in October. The November Consumer Price Index (CPI) is scheduled for release on Tuesday and provides the last major economic data point before this week’s Federal Open Market Committee (FOMC) meeting.

The FOMC meets this Tuesday and Wednesday. A 0.50% increase in the Fed funds rate is widely expected. When the FOMC met in September, the updated Summary of Economic projections indicated the terminal Fed funds rate for the current cycle would be 4.50% to 4.75%. With current Fed funds at 3.75% to 4.00%, a 0.50% increase takes rates to 4.25% to 4.50%. There is a likelihood we see an increase in the terminal Fed funds rate projection to above 5%. This could potentially push the rate cycle past the first quarter of 2023.

In our Dissecting Headlines section, we look at the historical performance of the Santa Claus Rally.

Financial Market Update

Dissecting Headlines: Santa Claus Rally

With Christmas on the way, one investing question that comes along this time of year is whether or not there will be a Santa Claus Rally in the stock market. The Santa Claus Rally is a year-end phenomenon where investors are looking for better than coal in their investment stockings.

According to the Stock Trader’s Almanac, the time period to measure the rally is the five final trading days of the year and the first two trading days of January. Since 1950, the S&P 500 Index has recorded a positive return on 57 occasions, or 80% of the time, during that time period. The average increase over those seven trading days has been +1.3%.

Whether it is optimism surrounding the U.S. consumer spending money, institutional positioning ahead of the new year, or just the holiday spirit, the impact has been a positive one over the years. The FOMC meeting this week could determine if the last few weeks of the year are naughty or nice to investors.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly December 12, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.