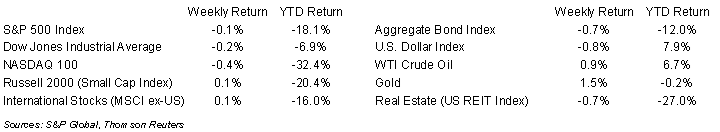

Equity markets ended the week down modestly and the year down substantially. For the week, the S&P 500 was -0.1%, the Dow was -0.2%, and the NASDAQ was -0.4%. The 10-year U.S. Treasury note yield increased to 3.831% at Friday’s close versus 3.747% the previous week.

This week’s major economic release is the December employment report scheduled for Friday. Strength in the labor market has been a factor working against the Federal Reserve’s efforts to slow inflation.

Fourth quarter 2022 earnings reporting starts this month. The current consensus for the S&P 500 Index is for a 1.6% decline in year-over-year earnings on 4.1% revenue growth. For full-year 2022, current consensus is 5.6% year-over-year earnings growth on 11.3% revenue growth. The early look for full-year 2023 is a consensus expectation of 4.4% earnings growth on 2.3% revenue growth.

In our Dissecting Headlines section, we examine current investor sentiment from the American Association of Individual Investors survey.

Financial Market Update

Dissecting Headlines: Investor Sentiment

When the market is going up, investors get bullish and eventually they are wrong. When the market is going down, investors get bearish and eventually they are wrong.

The current American Association of Individual Investors (AAII) survey indicates 47.6% of its weekly sentiment survey respondents are bearish and only 26.5% are bullish. The survey asks for investors opinion of where the stock market will be in the next six months. The survey is often seen as a contrarian indicator since above-average market returns have often followed unusually low levels of optimism, while below-average market returns have often followed unusually high levels of optimism. While not a perfectly correlated indicator, we can see the value in being greedy when others are fearful and fearful when others are greedy (paraphrase from Warren Buffet).

If we look one year ago just prior to the start of 2022, 37.7% of respondents were bullish and only 30.5% were bearish. As we know, the S&P 500 Index has declined 18.1% over the past year.

In December 2018, the S&P 500 Index had declined 4.4% on the year and the Fed had been raising interest rates. Bearish sentiment was 50.3% and bullish sentiment was only 31.6%. The Fed reversed policy in 2019 and the S&P 500 Index ended the year up 31.5%.

A year is a long time and timing can be difficult, but with bullish levels of sentiment below historical averages (current 26.5% versus 37.5% historical average) and bearish sentiment higher than average (current 47.6% versus 31.0% historical average), we think the end of the rate increase cycle (potentially by mid-year) would be a strong catalyst for improved returns in 2023.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly January 3, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.