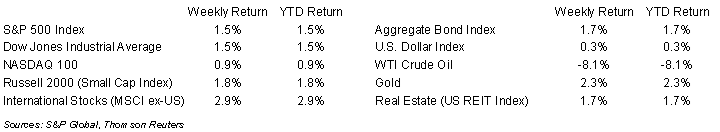

Equity markets kicked off the new year with an advance. The S&P 500 was +1.5%, the Dow was +1.5%, and the NASDAQ was +0.9% as Friday’s release of the December employment report sparked a strong rally to end the week. The 10-year U.S. Treasury note yield decreased to 3.571% at Friday’s close versus 3.831% the previous week.

The December employment report showed continued strength in the labor market with 223,000 new jobs created versus an expectation of 200,000. While above expectations, investors had a positive takeaway from lower growth in average hourly earnings (+0.3% month-to-month versus +0.4% month-to-month expectations) and a downward revision in November’s month-to-month average hourly earnings from 0.6% to 0.4%. The unemployment rate for December declined to 3.5% from a revised 3.6% in November. High levels of job openings had been creating labor cost inflation and a slowing of that metric could reduce overall inflation expectations moving forward.

Fourth quarter 2022 earnings reporting starts this month. The current consensus for the S&P 500 Index is for a 2.2% decline in year-over-year earnings on 4.1% revenue growth. For full-year 2022, current consensus is 5.5% year-over-year earnings growth on 11.2% revenue growth. The early look for full-year 2023 is a consensus expectation of 4.1% earnings growth on 2.2% revenue growth. Nine companies in the S&P 500 Index are scheduled to report earnings this week.

In our Dissecting Headlines section, we draw the distinction between a hard landing and soft landing for the economy.

Financial Market Update

Dissecting Headlines: Hard Landing versus Soft Landing

Following the December employment report, the financial news restarted the debate of a hard landing versus a soft landing for the economy. A “soft landing” is a slowdown in economic growth that avoids a recession as the Federal Reserve can use the monetary policy tools at its disposal to raise interest rates enough to slow inflation without causing a severe downturn. By contrast, a “hard landing” is a rapid slowdown in growth that causes a recession or severe downturn across a broad swath of the economy.

The Fed’s insistence that it would continuing raising short-term interest rates and keep them at a restrictive level for some time until real signs emerge on the progress of slowing inflation has kept most market watchers forecasting a hard landing, with a mix of calls for a shallow recession or just avoiding a recession in 2023. As we have previously discussed, the actual declaration of a recession is in the hands of the economists at the National Bureau of Economic Research.

A decline in the rate of inflation toward the Fed’s 2% target without severe economic damage in areas such as employment, industrial production, and consumer spending would result in a soft landing. A broad, severe decline across those economic inputs would likely cause NBER to declare a recession, solidifying a hard landing.

The airplane landing analogy works, if we assume that the Federal Reserve is the only pilot. The issue in the current economic environment is that several passengers (politicians, bureaucrats, foreign trade partners, and other institutions) have been able to jostle the controls.

Our next data point to watch is the December Consumer Price Index (CPI) report due for release this Thursday.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly January 9, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.