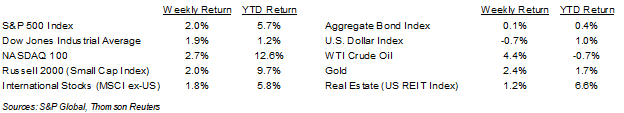

The equity markets have gotten off to a good start for March. Last week, the S&P 500 Index was +2.0%, the Dow was +1.9%, and the NASDAQ was +2.7%. The 10-year U.S. Treasury note yield increased to 3.963% at Friday’s close versus 3.949% the previous week.

Comments from Federal Reserve officials that the Federal Open Market Committee (FOMC) could been done raising rates by this summer, if the recent inflationary data proves to be a blip, injected some optimism for investors. Fed Chair Jerome Powell testifies to Congress this week and the February employment report is scheduled for Friday. Both events could be significant in setting expectations ahead of the March 22nd FOMC meeting.

Fourth quarter earnings reporting is nearing an end with 493 companies complete in the S&P 500 Index. Another four companies are scheduled to report earnings this week. The current consensus for fourth quarter earnings for the S&P 500 Index is a 3.2% decline in year-over-year earnings on 5.8% revenue growth. For full-year 2022, current consensus is 4.8% year-over-year earnings growth on 11.6% revenue growth. The current consensus expectation for full-year 2023 is 1.5% earnings growth on 1.8% revenue growth.

In our Dissecting Headlines section, we look at recent Federal Reserve comments on the influence of upcoming data on potential interest rate policy decisions for March.

Financial Market Update

Dissecting Headlines: Reading the Fed

Last week, Federal Reserve board member Christopher Waller said the jobs and inflation data released between now and the Fed’s upcoming March meeting are likely key to whether he and other policymakers tilt towards higher interest rates. If the data shows the economy moderating and inflation slowing, then he would endorse the December target rate of 5.00% to 5.25%, but if they did not then he would advocate for higher rates.

Atlanta Fed president Raphael Bostic said he was also ready to raise interest rates higher if upcoming data did not show inflation clearly heading back towards the Fed’s target of 2%. Investors focused on his more dovish comment that the impact of Fed rate increases may not fully be felt yet in the economy and that the Fed should be careful in deciding on further rate hikes so they don’t overstep. He advocated a slow and steady course of action with perhaps only two more 0.25% interest rate increases needed before the Fed can pause. He thinks the impact of rate increases should start to impact the economy this spring and going at a measured pace reduces the likelihood the Fed overshoots and damages the economy.

This week Fed Chair Jerome Powell testifies to the Senate Banking Committee on Tuesday and the House Financial Service Committee on Wednesday. His comments along with the February employment report should set the tone for the week. Next week’s Consumer Price Index (CPI) and Producer Price Index (PPI) reports set for Tuesday and Wednesday provide us current data points on inflation that the FOMC is likely to weigh in their policy decisions.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly March 6, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.