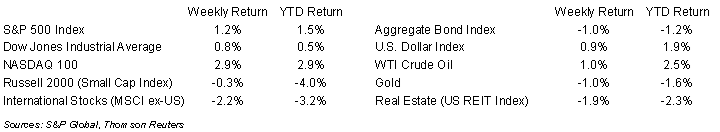

The S&P 500 Index returned to record high territory last week. For the week, the S&P 500 Index was +1.2%, the Dow was +0.8%, and the NASDAQ +2.9%. The S&P 500 Index was led by the Technology, Communication Services, and Financial sectors, while the Energy, Utility, and Real Estate sectors lagged. The 10-year U.S. Treasury note yield increased to 4.146% at Friday’s close versus 3.950% the previous week.

CME Fed funds futures now imply a 53.4% probability that rates remain in the 5.25% to 5.50% target range for March and that the first rate cut happens in May. Last week, the futures implied a 69.0% probability for a rate cut in March, so the market is starting to push out expectations. The close to even odds for a rate cut in March are likely to be volatile as additional data comes out over the next few weeks. The next key event is the December PCE Price Index scheduled for Friday, followed by the January Federal Open Market Committee (FOMC) meeting on January 30th – 31st.

Earnings reports pick up this week with 61 companies in the S&P 500 Index scheduled to report earnings. Current fourth quarter expectations for the S&P 500 Index are earnings growth of 4.5% and revenue growth of 2.5%. For full-year 2023, S&P 500 Index earnings are expected to grow by 2.8% with revenue growth of 1.9%. For full-year 2024, earnings are expected to grow by 10.9% with revenue growth of 5.0%.

In our Dissecting Headlines section, we look at the recent S&P 500 high.

Financial Market Update

Dissecting Headlines: S&P 500 Recovery

The S&P 500 Index recovered to an all-time closing high on Friday. The Index’s previous closing high was January 3, 2022 just before the large decline set in for that year. The market bottomed for this cycle in October 2022 with a closing low on October 12th representing a 25.4% price decline from the January peak. 2022 saw the series of rapid interest rate increases to combat soaring inflation, so that is one difference from the January 2022 peak to now.

Friday’s close is a 35.3% advance from the October 2022 low. Much of the current optimism for the equity market is due the potential for the Federal Reserve to lower interest rates this year. While there is argument the interest rate reductions could come later than anticipated, with inflation trending in the right direction, they do likely come this year. This also means the yield curve inversion we have seen over the past 18 months is likely to start to take a more normal shape. A reacceleration in corporate earnings adds to the optimism.

While there are certainly risks to monitor at home and around the world, for now, the Bulls have the upper hand with their eyes set on growing corporate earnings and a more favorable inflationary environment leading to lower short-term interest rates sometime this year.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly January 22, 2024

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.