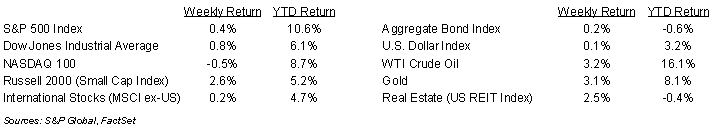

Stocks closed out a strong first quarter of the year with moderate gains during a holiday shortened week. For the week, the S&P 500 Index was +0.4%, the Dow was +0.8%, and the NASDAQ was -0.3%. The best performing sectors in the S&P 500 Index were the Utility, Real Estate, and Materials sectors, while the Consumer Discretionary, Technology, and Communication Services sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.206% at Thursday’s close versus 4.215% the previous week. For the first quarter of the year, the S&P 500 Index was +10.6%, the Dow was +6.1%, and the NASDAQ was +9.3%.

Speaking in California on Friday, Fed Chair Jerome Powell indicated that economic growth gives the Fed the time to make sure inflation has subsided before lowering interest rates. Based on CME Fed funds futures, investors are forecasting a 68.5% probability the first rate reduction could come at the June FOMC meeting.

The next economic data point for the labor market is the March Employment Situation Report scheduled for this Friday. Economists are expecting monthly job growth in the 180,000 to 200,000 range with the unemployment rate remaining at 3.9%.

The first quarter earnings reporting period begins next week. The current first quarter consensus forecast for the S&P 500 Index is 5.1% earnings growth with revenue growth of 3.3%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 9.9% with revenue growth of 4.7%.

In our Dissecting Headlines section, we look at the current investor sentiment.

Financial Market Update

Dissecting Headlines: Investor Sentiment

After a strong first quarter, investor sentiment is bullish on stocks. Based on the weekly sentiment survey from the American Association of Individual Investors (AAII), the March 27th survey had Bullish sentiment of 50.0% versus 48.6% at the start of the year and the historical average of 37.5%. Bearish sentiment of 22.4% for the week was lower than the 23.5% at the start of the year and the historical average of 31.0%.

The survey data is based on the question, “What direction do you feel the stock market will be in the next six months?” The results are often seen as a contrarian indicator since below-average market returns have often followed unusually high levels of optimism while above-average market returns have often followed unusually low levels of optimism.

Last week’s survey also asked a question on the current state of the economy. “Great” received only a 9.0% response, “Good” received the highest response with 43.6%, “Mixed” had a 38.8% response, and “Lousy” was at 8.0%. The feeling of Good/Mixed seems appropriate given an economy that is sitting in limbo between a monetary tightening cycle and a monetary easing cycle.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly April 1, 2024

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.