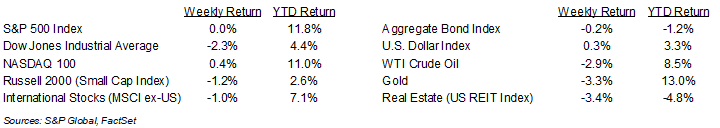

Stocks leveled off last week after a multi-week advance. For the week, the S&P 500 Index was flat, the Dow was -2.3%, and the NASDAQ was +0.4%. Within the S&P 500 Index, the Technology and Communication Services sectors were the only two with a weekly advance. The Energy, Real Estate, and Financial sectors were the biggest laggards. The 10-year U.S. Treasury note yield increased to 4.464% at Friday’s close versus 4.422% the previous week.

The economic focus this week should be the April Personal Consumption Expenditures (PCE) Price Index scheduled for release on Friday. This is the economic data series the Federal Reserve favors in measuring and forecasting inflation. Current CME Fed funds futures show no changes in interest rates are likely for the June and July meetings. The probability for an initial cut in the Fed funds target rate in September is at 51.2%.

The first quarter earnings reporting season for the S&P 500 Index is 96% complete. For the coming week, nine companies in the S&P 500 Index are scheduled to report earnings. The current first quarter consensus forecast for the S&P 500 Index is 6.0% earnings growth with revenue growth of 4.2%. Looking ahead to the second quarter, earnings growth is expected to accelerate to 9.3% year-over-year with revenue growth of 4.9%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 11.4% with revenue growth of 5.0%.

In our Dissecting Headlines section, we look at a recent poll about how people see the economy.

Financial Market Update

Dissecting Headlines: Main Street Disconnect

A poll conducted by Harris for The Guardian showed that many Americans have a more pessimistic view of the economy than economic data would support. The poll was conducted between May 10th and 12th.

The poll showed 55% of those surveyed believe the economy is shrinking and 56% think the U.S. is currently experiencing a recession. A recession has not been declared by the National Bureau of Economic Research and gross domestic product (GDP) has grown for the past seven quarters. The most recent decline in GDP was the first and second quarters of 2022.

Almost half, 49% of those surveyed, thought the S&P 500 Index was down for the year. Year-to-date of the survey period (May 10th) the S&P 500 was up 10.0%.

Almost half, 49% of those surveyed, believed that unemployment is at a 50-year high. The April Employment Situation report, released on May 3rd, showed the unemployment rate at 3.9%, near a 50-year low.

Most respondents, 72% of those surveyed, thought inflation is increasing. The rate of inflation, while above the Federal Reserve’s target rate of 2%, has declined since its peak in mid-2022 and has been range-bound the past few months.

Our thought is that American consumers are feeling some emotional exhaustion. They went from the disorienting impact of the pandemic to a rapid increase in inflation and 2022’s market decline. While the rate of inflation has subsided, prices in many categories have not declined. For younger Americans, higher mortgage rates and higher home prices have made some think that home ownership may never be possible. Lastly, layoffs are starting to occur, mainly in industries that over hired during the “war for talent” during the pandemic or among individuals that have been working from home and elected to not return to the office when required. In all, the past four years have been a succession of economic uncertainties that may have left many Americans with a more pessimistic view of the economy than official measurements would indicate.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly May 28, 2024

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.