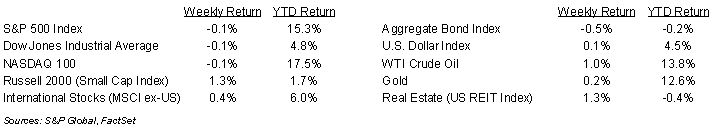

Stocks fell modestly last week but closed out the first half of 2024 with gains. For the week, the S&P 500 Index was -0.1%, the Dow was -0.1%, and the NASDAQ was -0.1%. Within the S&P 500 Index, the Energy, Communication Services, and Consumer Discretionary sectors led, while the Utility, Materials, and Consumer Staples sectors lagged. The 10-year U.S. Treasury note yield increased to 4.370% at Friday’s close versus 4.253% the previous week.

The Personal Consumption Expenditures (PCE) Price Index for May showed prices flat month-over-month and core prices, which exclude food and energy, +0.1%. Prices for PCE and core PCE were both +2.6% year-over-year. For the coming week, the June Employment Situation Report is scheduled for release on Friday. Based on CME Fed funds futures, the probability of a September rate cut is currently 62.6%. Futures also imply a second rate cut by year end, contrary to the Fed’s current projections.

Second quarter earnings reports will ramp up as we move into July. For the second quarter, S&P 500 Index earnings growth is expected be 8.8% higher year-over-year with revenue growth of 4.6%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 11.3% with revenue growth of 5.0%.

In our Dissecting Headlines section, we look at where the market stands at halftime and what to look for in the second half of the year.

Financial Market Update

Dissecting Headlines: Second Half Outlook

The S&P 500 Index ended the first half of 2024 with a 15.3% gain year-to-date. The majority of the year-to-date gain came from the first quarter’s 10.6% advance. The second quarter gain was 4.3%. U.S. stocks outperformed International stocks with the S&P 500 Index at +15.3% versus the MSCI ex-US Index at +6.0%. Large cap stocks also outperformed small cap stocks with the S&P 500 Index at +15.3% and the Russell 2000 Index at +1.7%.

Ten of the Index’s eleven sectors are positive for the year. In order, returns by sector are Information Technology +28.2, Communication Services +26.7%, Energy +10.9%, Financials +10.2%, Utilities +9.4%, Consumer Staples +9.0%, Health Care +7.8%, Industrials +7.8%, Consumer Discretionary +5.7%, Materials +4.1%, and Real Estate –2.5%.

Looking at growth for the remainder of the year, second quarter earnings for the S&P 500 Index are forecasted at +8.8% on 4.6% revenue growth. Third quarter earnings are currently expected at +8.2% on 4.9% revenue growth. Fourth quarter earnings are currently expected at +17.6% on revenue growth of 5.5%.

Market drivers for the second half of the year include the timing and degree of changes in short-term interest rates by the Federal Reserve, the health of the U.S. consumer as high inflation continues to take it toll, and the Presidential election in November.

Investor sentiment, as measured by the American Association of Individual Investors (AAII) survey, is modestly positive compared to historical levels. The current survey reading is 44.5% Bullish, 27.2% Neutral, and 28.3% Bearish versus the historical average of 37.5% Bullish, 31.5% Neutral, and 31.0% Bearish. Extremes in the survey can sometimes be contrarian indicators. At the start of the year, the survey was 46.3% Bullish, 28.6% Neutral, and 25.1% Bearish, so sentiment has moderated a bit after the strong first half of the year.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly July 1, 2024

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.