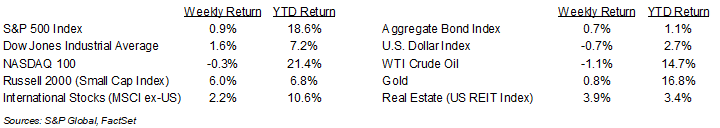

Upside spread to wider areas of the equity market as investors gained confidence that inflation is trending lower and that rate cuts are on the horizon. For the week, the S&P 500 Index was +0.9%, the Dow was +1.6%, and the NASDAQ was -0.3%. Within the S&P 500 Index, the Real Estate, Utility, and Materials sectors led, while the Communication Services, Consumer Staples, and Consumer Discretionary sectors lagged. Small cap stocks saw a week of leadership with the Russell 2000 returning 6.0%. The 10-year U.S. Treasury note yield decreased to 4.177% at Friday’s close versus 4.278% the previous week.

The June Consumer Price Index (CPI) was -0.1% month-over-month and +3.0% year-over-year. Core CPI, which excludes food and energy prices, was +0.1% month-over-month and +3.3% year-over-year. This data was less inflationary than forecast and, coupled with comments from Fed Chair Jerome Powell that the likely next direction is a loosening of monetary policy, shifted optimism that an initial 0.25% reduction in the Fed funds rate is coming in September, and that additional rate cuts are possible in both November and December.

Second quarter earnings reports ramp up further this week with 45 companies in the S&P 500 Index scheduled to report earnings. For the second quarter, earnings growth is expected be 9.3% higher year-over-year with revenue growth of 4.6%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 11.2% with revenue growth of 5.0%.

In our Dissecting Headlines section, we look at the CPI report and expectations for interest rates for the remainder of the year.

Financial Market Update

Dissecting Headlines: Rate Expectations

While the CPI report showed year-over-year inflation at +3.0% and core inflation at +3.3%, the smaller incremental monthly moves, -0.1% for CPI and +0.1% for core CPI, gave investors confidence the inflation we have lived with for over two years is starting to return to more normalized levels. Within the CPI, most categories are trending within acceptable levels, except for shelter costs which remain 5.2% higher year-over-year. Both new and used vehicle prices are lower year-over-year, apparel is +0.8% year-over-year, and food at home (groceries) is +1.1% year-over-year. While these disinflationary categories do not erase the prices increases over the past few years, prices are stabilizing.

While the Federal Reserve is expected to keep the Fed funds rate at its current 5.25% to 5.50% range at its July meeting, the CME Fed funds futures now imply a 94.3% probability of a 0.25% rate cut at the September meeting, up significantly from 75.6% a week ago. Additionally, the futures have shifted to a 60.2% probability of a 0.25% rate cut at the November meeting and a 53.5% probability of an additional rate cut at the December meeting.

The Fed has stressed it is data dependent and wants to ensure that it is confident inflation is moving toward its 2% annualized target before embarking on monetary easing. At his report to Congress last week, Jerome Powell did state that risks are more balanced in the economy and that both inflation and the labor market are moving in the right directions. While he repeated that they aren’t at a point yet where the Fed feels confident to lower the Fed funds rate, he did acknowledge that if Fed reduces policy too late, it could hurt the economy, and if Fed reduces policy too soon, it could impact progress on inflation. The data over the next few months should be key to where monetary policy and the economy end up by December.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly July 15, 2024

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.