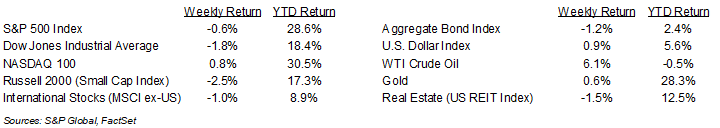

The S&P 500 Index fell modestly last week. For the week, the S&P 500 was -0.8%, the Dow Jones Industrials -1.8%, and the NASDAQ +0.8%. The Communication Services, Consumer Discretionary and Technology sectors led the market, while the Materials, Utility and Health Care sectors lagged. The 10-year U.S. Treasury note yield increased to 4.398% at Friday’s close versus 4.149% the previous week.

The Federal Reserve’s final meeting of the year is scheduled for Tuesday and Wednesday. Current CME Fed funds futures show a 97% probability of the 0.25% rate cut to a 4.25% to 4.50% target range. The Fed should also issue an updated Summary of Economic Projections at the meeting, providing a road map for the first quarter of 2025. Fed funds futures for the first quarter currently show a 0.25% reduction in interest rate. The incoming Trump administration is working on a combination of tax policy, trade and tariff policy, and government spending reductions. This likely causes the Federal Reserve to take a wait and see approach to how new policies impact the economy and its need to further adjust monetary policy.

Last week’s inflation data in the Consumer Price Index (CPI) and Producer Price Index (PPI) showed inflation is still sticky, but that doesn’t seem to be enough to put the Federal Reserve on pause this week. As mentioned, it is more likely that the pace of rate cuts slow in 2025 as the Federal Reserve adjusts monetary policy to a more neutral stance.

Fourteen companies in the S&P 500 Index are scheduled to report earnings results this week. Fourth quarter earnings growth is currently forecast at 11.8% year-over-year with revenue growth of 4.8%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 9.5% with revenue growth of 5.1%.

In our Dissecting Headlines section, we look at the historic probability of a Santa Claus Rally.

Financial Market Update

Dissecting Headlines: Santa Claus Rally

As we approach the end of the year, investors often wonder if the stock market will have a Santa Claus Rally. Based on historical returns, the probability is good.

According to the Stock Trader’s Almanac, the actual Santa Claus Rally period measures the five final trading days of the year and the first two trading days of January. Since 1950, the S&P 500 Index has recorded a positive return on 59 occasions, or 80% of the time, during that period. The average increase over those seven trading days has been +1.3%.

Whether it is optimism surrounding the U.S. economy, institutional positioning ahead of the new year, or just the holiday spirit, the impact has been a positive one over the years. This year, the Federal Reserve certainly has the potential to add to the joy as it is widely expected to lower interest rates again at its December 18th meeting.

With the S&P 500 Index up over 28% year-to-date, some could also argue that the entire year has been a gift, and an extra one-percent return at the end of the year would merely be an extra stocking stuffer.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly December 16, 2024

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.