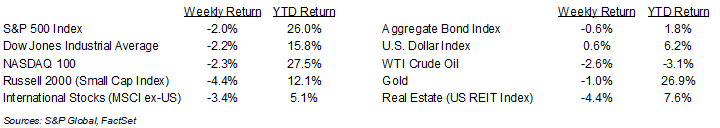

Equities declined last week after the Federal Reserve reduced its outlook for the number of interest rate reductions it plans for 2025. For the week, the S&P 500 Index was -2.0%, the Dow Jones Industrials -2.2%, and the NASDAQ -2.3%. All eleven S&P sectors declined with the Technology, Utility, and Financial sectors declining the least and the Energy, Real Estate, and Materials sectors declining the most. The 10-year U.S. Treasury note yield increased to 4.530% at Friday’s close versus 4.398% the previous week.

The Federal Reserve reduced the Fed funds target rate by 0.25% to a 4.25% to 4.50% target range as expected. The Fed also reduced its outlook for rate cuts in 2025 from a total of 1.00% to a total of 0.50%, or a target range of 3.75% to 4.00%. The Fed cited a still strong economy, and the need assess the economic impact of policy proposals from the new presidential administration. Based on CME Fed funds futures, the Fed is expected to pause at its January meeting and reduce the Fed funds rate by 0.25% at its March meeting.

No companies in the S&P 500 Index are reporting during the holiday week. Fourth quarter earnings growth is currently forecast at 11.9% year-over-year with revenue growth of 4.6%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 9.4% with revenue growth of 5.1%. Full-year 2025 earnings are expected to grow by 14.8% with revenue growth of 5.8%.

In our Dissecting Headlines section, we look at the Fed’s Summary of Economic Projections.

Financial Market Update

Dissecting Headlines: Summary of Economic Projections

The Federal Reserve’s latest Summary of Economic Projections was released at its Federal Open Market Committee (FOMC) policy meeting last week. The committee members’ views on the economy are what underpin their decisions on monetary policy. We thought it would be helpful to look at where the economic data is currently relative to the FOMC’s outlook for 2025 to better understand potential policy decisions for next year.

Gross Domestic Product (GDP): The FOMC expects the economy, as measured by GDP, to grow 2.1% in 2025 versus its previous expectation of +2.0% and the recent third quarter level of +3.1%.

Unemployment: As of November, the unemployment rate was 4.2%. The FOMC projects the unemployment rate increasing to 4.3% in 2025. The higher unemployment can help reduce wage pressure which is often passed on to consumers in the form of higher prices, so modestly higher unemployment can help keep inflation in check.

Inflation: The FOMC measures inflation via the Personal Consumption Expenditures (PCE) Price Index. November’s PCE Prices were +2.4% year-over-year and core PCE Prices, which exclude food and energy prices, were +2.8%. The FOMC’s projections show PCE Prices rising modestly to +2.5% in 2025 versus its previous projection of a decline to +2.1%. Core PCE prices are also forecast to be at +2.5% in 2025, lower from the current level, but higher than the previous forecast of +2.2%.

Interest Rates: Based on these economic projections, the FOMC sees the Fed funds rate target for year-end 2025 at 3.75% to 4.00%, a half percentage point lower than the current 4.25% to 4.50% range. This is a more restrained level of interest rate reductions than the full percentage point reduction forecast at the September meeting. The potential for higher inflation was likely the determining factor in the tempering of the interest rate reduction forecast. We expect the FOMC to remain data dependent and forecasts are likely to shift as the economy evolves in 2025.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly December 23, 2024

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.