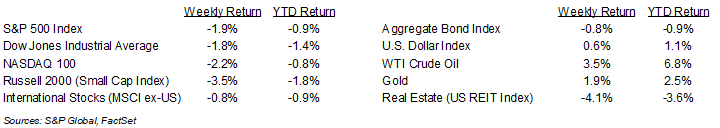

Higher bond yields and a strong December employment report weighed on stocks last week. For the week, the S&P 500 Index was -1.9%, the Dow Jones Industrials -1.8%, and the NASDAQ -2.2%. The only three positive sectors in the S&P 500 Index for the week were the Energy, Health Care, and Materials sectors. The Real Estate, Technology, and Financial sectors saw the biggest downside. The 10-year U.S. Treasury note yield increased to 4.767% at Friday’s close versus 4.597% the previous week.

The U.S. economy saw 256,000 net new jobs created in December versus an expectation of 155,000. The December unemployment rate fell to 4.1% from 4.2% in November. This employment strength may keep further short-term interest rate reductions on hold. Based on CME Fed funds futures, interest rates reductions are currently seen on hold until the June Federal Open Market Committee (FOMC) Meeting. This week we will get data on inflation with the December Producer Price Index (PPI) scheduled for Tuesday and the Consumer Price Index (CPI) scheduled for Wednesday.

Additional sanctions imposed on Russia have pushed oil prices higher. WTI crude oil was 3.5% higher last week and is 6.8% higher year-to-date.

The fourth quarter earnings reporting period increases tempo this week with 20 companies, including several large banks, in the S&P 500 Index scheduled to report earnings. Fourth quarter earnings growth is currently forecast at 11.7% year-over-year with revenue growth of 4.7%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 9.4% with revenue growth of 5.0%. Full-year 2025 earnings are expected to grow by 14.8% with revenue growth of 5.8%.

In our Dissecting Headlines section, we look at the factors impacting interest rates.

Financial Market Update

Dissecting Headlines: Interest Rates

When the Federal Reserve released its Summary of Economic Projections in December, it shifted to an outlook of 0.50% in total interest rate reductions for 2025 from a previous outlook of a total of 1.0% in reductions. The commentary was that initial policy moves by the incoming administration could prevent or delay the path to 2.0% inflation that the Fed was targeting. The unknown economic impact of a more aggressive tariff policy could continue to push inflation.

As part of the Economic Projections, the Fed saw the unemployment rate rising to 4.3% in 2025. After Friday’s release of the December employment situation report, which saw the unemployment rate drop to 4.1% from 4.2% a month earlier, the concern among investors has now shifted to a stronger labor market which could possibly erase even the 0.50% in projected reductions to the Fed funds rate in 2025.

At the same time short-term interest rates are looking stickier due to concerns over inflation and a stronger labor market, long-term interest rates are on the rise. The 10-year U.S. Treasury bond yield has risen to 4.767% from 4.228% a month ago. The yield curve is returning to its normal shape, but with stickiness in rate reductions on the short-end, the steepening is occurring via higher yields on the longer-end.

The vote for sustained inflation is currently winning the day. That thesis will play out once the new administration comes into office and economic data supports or modifies the current view over the next few months.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly January 13, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.