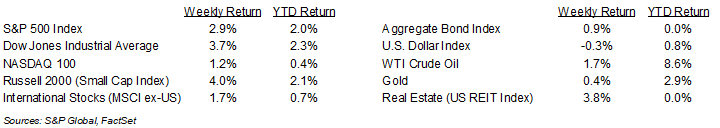

A more constructive outlook on inflation gave equity markets a boost last week. For the week, the S&P 500 Index was +2.9%, the Dow Jones Industrials +3.7%, and the NASDAQ +1.2%. The S&P 500 Index was led by the Energy, Financials, and Materials sectors, while the Health Care, Consumer Staples, and Communication Services sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.610% at Friday’s close versus 4.767% the previous week.

Retail inflation, as measured by the Consumer Price Index (CPI) was +0.4% month-over-month and +2.9% year-over-year. Core CPI, which excludes food and energy prices, was +0.2% month-over-month and +3.2% year-over-year. This gave investors some confidence that rate reductions from the Federal Reserve could still materialize as inflation eases over time. The Fed is likely to pause the rate reductions for the next few meetings while it waits for data to better gauge the new administration’s impact on the economy. A peaceful transition between the Biden administration and Trump administration should ease some stress. The next 100 days are important to see what progress the new administration can make to benefit consumers as promised on the campaign trail.

The fourth quarter earnings reporting period presses on this week with 43 companies in the S&P 500 Index scheduled to report earnings. Fourth quarter earnings growth is currently forecast at 12.5% year-over-year with revenue growth of 4.7%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 9.4% with revenue growth of 4.9%. Full-year 2025 earnings are expected to grow by 14.8% with revenue growth of 5.9%.

In our Dissecting Headlines section, we look at the executive orders signed by President Trump with economic implications.

Financial Market Update

Dissecting Headlines: Executive Orders

Following the inauguration, President Trump started signing executive orders. Several could have economic impact over the next few months.

Energy: The president declared a national energy emergency and instructed the Department of the Interior to offer new drilling and extraction leases on federal lands. The goal is to bring down energy prices and benefit the U.S. as an exporter of energy. He also revoked the electric vehicle mandate and halted permitting for wind energy projects.

Government Spending: He authorized the establishment of the Department of Government Efficiency (DOGE) to maximize government efficiency and productivity. He also authorized a temporary hiring freeze on federal workers and signed an order requiring federal employees to return to the office. The goal is to reduce government spending.

Climate and Health: He signed orders to exit both the Paris Climate Accords and the World Health Organization. The first could benefit U.S. manufacturers with environmental compliance.

Tariffs: No tariff orders were signed, but the president said he planned on tariffs up to 25% on certain goods to be imposed on Mexico and Canada starting in February. No new tariffs were imposed on China until the president has an opportunity to speak and negotiate with Xi Jinping. Both these actions reinforce the view that the tariffs are a negotiating tool, and their degree of implementation and economic impact are yet unknown.

More executive orders and policy announcements are likely to come rapidly as the new administration begins getting cabinet levels positions approved and filled.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly January 21, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.