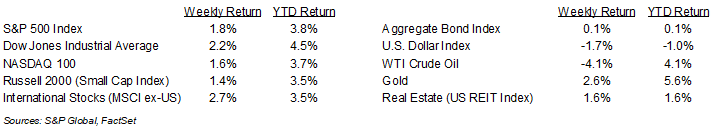

The S&P 500 Index hit a new high last week before closing lower on Friday. For the week, the S&P 500 Index was +1.8%, the Dow Jones Industrials +2.2%, and the NASDAQ +1.6%. The S&P 500 Index was led by the Communication Services, Health Care, and Industrial sectors, while the Energy, Materials, and Consumer Discretionary sectors lagged. The 10-year U.S. Treasury note yield increased to 4.621% at Friday’s close versus 4.610% the previous week.

President Trump spoke remotely to the World Economic Forum at Davos. He said the U.S. is open for business and he welcomes investment and cooperation with countries and companies that want to do business. He reiterated several of his agenda points to include greater utilization of U.S. energy assets, NATO member countries increasing their defense spending to 5% of their GDP, and the use of tariffs as a negotiating tool to encourage investment and manufacturing in the U.S.

We will hear from the Federal Reserve at the conclusion of its meeting on Wednesday. At the post meeting press conference, Fed Chair Jerome Powell is likely to get questions not only on monetary policy but also on President Trump’s recent demand that interest rates drop. The Fed is widely seen as being on pause with interest rates for both the January and March meetings. Based on CME Fed funds futures, probabilities for a 0.25% reduction at the May meeting are now at 61.6% versus being seen as a pause last week.

The fourth quarter earnings reporting period continues to ramp up this week with 102 companies in the S&P 500 Index scheduled to report earnings. Fourth quarter earnings growth is currently forecast at 12.7% year-over-year with revenue growth of 4.6%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 9.5% with revenue growth of 4.9%. Full-year 2025 earnings are expected to grow by 14.8% with revenue growth of 5.9%.

In our Dissecting Headlines section, we look at DeepSeek, the Chinese AI start-up that is rattling the technology industry.

Financial Market Update

Dissecting Headlines: DeepSeek

The tech industry was buzzing over the weekend of the potential impact of Chinese AI start-up DeepSeek. The company has developed an artificial intelligence model on par with OpenAI and Meta’s Llama, but is said to have been developed for a substantially lower cost of approximately $6 million and using less powerful chips. The open-source application has quickly shot to the top of the Apple App Store ranking as users want to try the latest tech.

The news is raising some concern whether the current AI “arms race” among big technology companies is worth the high level of spending seen in recent quarters. This in turn likely puts some pressure on the AI supply chain to include chips and other areas of high spend.

This comes at a time when newly inaugurated President Donald Trump would like the United States to be the world leader in artificial intelligence. Last week, the president held a press conference along with leaders from SoftBank, Open AI, and Oracle to announce a joint venture for AI infrastructure called Stargate. The venture is expected to draw up to $500 billion in investment starting with a large data center in Texas.

The evolution of AI continues at a rapid pace. The breadth of its adoption and commercial viability are still unknown, but its reshaping of many areas of the economy are already underway.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly January 27, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.