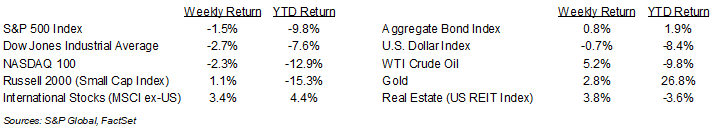

While there is currently a 90-day pause on the implementation of some tariffs, the impact and timing of trade negotiations with multiple countries presents a risk that is causing some investors to be tentative in buying equities. Last week, the S&P 500 Index was -1.5%, the Dow Jones Industrials -2.7%, and the NASDAQ -2.3%. The S&P 500 Index was led by the Real Estate, Energy, and Consumer Staples, while the Technology, Consumer Discretionary, and Communication Services sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.337% at Thursday’s close versus 4.468% the previous week.

Speaking at the Economic Club of Chicago last week, Fed president Jerome Powell was consistent in his view that the Fed needs to wait on data before making any changes to policy stance. He did express that tariffs were likely to increase inflation and potentially weaken economic growth and employment. While the Fed is awaiting data, the current CME Fed funds futures indicate there could be up to 1.0% in reductions to the Fed funds rate by December. Much of the uncertainty may resolve itself both in the progress of trade negotiations and economic data over the next few months. Current trade discussions are underway with key partners to include Japan, South Korea, India, the United Kingdom, and Italy on behalf of the European Union.

First quarter earnings season continues this week with 122 companies in the S&P 500 Index scheduled to report earnings results. First quarter 2025 earnings growth is currently forecast at 7.2% year-over-year with 4.3% revenue growth. Full-year 2025 earnings are expected to grow by 10.0% with revenue growth of 5.1%.

In our Dissecting Headlines section, we look at the upcoming report for first quarter Gross Domestic Product (GDP).

Financial Market Update

Dissecting Headlines: Gross Domestic Product

First Quarter Gross Domestic Product (GDP) is scheduled for release on April 30th. The report will be the first gauge of economic growth since the new administration came to office in January and the initial tariffs went into effect for China, Mexico, and Canada later in the quarter.

Since the tariffs were not in effect for the full quarter, the thought that tariffs would negatively impact growth may not be seen until later quarters. Speaking over the weekend, Chicago Fed president Austan Goolsbee said he thinks the threat of tariffs may have caused some business to preemptively stock up on inventory. He thinks this could be followed by a drop off in economic activity over the summer.

The current consensus forecast for first quarter GDP is 2.3% year-over-year. Some of the regional Federal Reserve Banks that provide GDP forecasts are bracketed around that number with the Atlanta Fed at –2.2%, the New York Fed at +2.7%, and the St. Louis Fed at +2.8%.

The results, and details within first quarter GDP, should help better refine the starting point for the economy as tariffs started to be implemented. Subsequent quarters may be reliant on the progress of current trade talks.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly April 21, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.