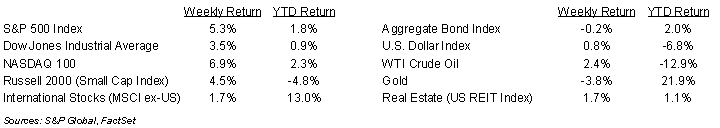

Stocks rallied as tame inflation and progress on trade deals calmed fears. For the week, the S&P 500 Index was +5.3%, the Dow Jones Industrials +3.5%, and the NASDAQ +6.9%. The S&P 500 Index was led by the Technology, Consumer Discretionary, and Communication Services sectors, while the Health Care, Real Estate, and Consumer Staples sectors lagged. The 10-year U.S. Treasury note yield increased to 4.445% at Friday’s close versus 4.369% the previous week.

The April Consumer Price Index (CPI) and Producer Price Index (PPI) showed a less inflationary economic environment. CPI was +0.2% month-over-month and +2.3% year-over-year and core CPI, which excludes the impact of food and energy prices, was +0.2% month-over-month and +2.8% year-over-year. The April Producer Price Index (PPI) was -0.5% month-over-month and +2.4% year-over-year and core PPI was -0.1% month-over-month and +2.9% year-over-year.

Fed officials continue to express concern on inflation due to trade and tariff policies, but the Fed will likely need to quantify its outlook at the June 18th Federal Open Market Committee (FOMC) meeting when an update to the Summary of Economic Projections is due. Current CME Fed funds futures show a total of 0.50% reduction in rates for the year. This is in line with the FOMC’s March projections for monetary policy.

We are in the last legs of first quarter earnings season with 92% of companies in the S&P 500 Index complete on reporting. This week, 18 companies in the S&P 500 Index are scheduled to report earnings results. First quarter 2025 earnings growth is currently forecast at 13.6% year-over-year with 4.8% revenue growth. Full-year 2025 earnings are expected to grow by 9.0% with revenue growth of 4.9%.

In our Dissecting Headlines section, we look at the forecast for Memorial Day travel.

Financial Market Update

Dissecting Headlines: Memorial Day Travel

Despite concerns about tariffs, lower gasoline prices are fueling the opportunity to travel over Memorial Day weekend, the unofficial start of Summer. The American Automobile Association (AAA) forecasts 45.1 million Americans will travel more than 50 miles from their homes during the holiday weekend, a 3.2% increase year-over-year.

Auto travel is the most prevalent, with 39.4 million Americans expected to travel by car, a 3.1% increase year-over-year. National average gasoline prices are 11.5% lower year-over-year at $3.179 per gallon providing an incentive to hit the road. This should help defray other travel expenses such as food away from home, which is 3.9% higher based on the most recent CPI report.

Airlines should carry 3.61 million travelers for the holiday weekend, 1.7% higher year-over-year. Airfares are 2.0% higher year-over-year. Other modes of travel, to include trains and buses, are expected to carry 2.08 million passengers, an increase of 8.3% year-over-year.

Hotel and motel prices are an average of 2.3% less expensive year-over-year based on recent CPI data. Other holiday weekend expenses are also lower, to include sports equipment down 3.7%, toys down 1.4%, and apparel down 0.7%. Higher expenses include movie and concert admissions up 3.4% and sporting events up 9.3%.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly May 19, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.