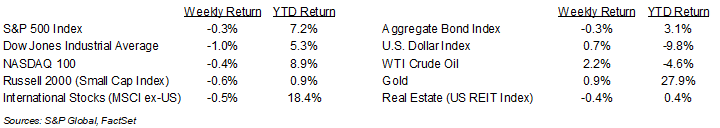

A resurgence of tariff announcements put a pause in the recent rally. For the week, the S&P 500 Index was -0.3%, the Dow Jones Industrials -1.0%, and the NASDAQ -0.4%. The Materials, Financials, and Technology sectors led the S&P 500 Index for the week, while the Communication Services, Utilities, and Consumer Discretionary sectors lagged. The 10-year U.S. Treasury note yield increased to 4.340% at Friday’s close versus 4.284% the previous week.

The U.S. sent letters to several countries informing them of new tariff rates going into effect on August 1st. This was likely meant to speed negations among countries that haven’t addressed trade issues. Some headline volatility is likely to persist as last-minute negotiations continue for the next few weeks. Mexico, as an example, has expressed confidence it will reach an agreement on a lower tariff level than the 30% it was notified of last week.

Key economic data for this week include the June Consumer Price Index (CPI) and Producer Price Index (PPI) reports. This is the final inflation data ahead of the Federal Open Market Committee (FOMC) meeting on July 30th, since the June Personal Consumption Expenditures (PCE) Price Index isn’t scheduled for release until July 31st. The FOMC is expected to hold interest rates steady at its July meeting. CME Fed funds futures forecast 0.25% rate cuts at the September and December meetings.

The second quarter earnings reporting period begins this week. Forty-two companies in the S&P 500 Index are scheduled to report earnings. Current expectation for the S&P 500 Index is earnings grow at 4.8% year-over-year with revenue growth of 4.2%. Full-year 2025 earnings are expected to grow by 9.0% with revenue growth of 5.0%.

In our Dissecting Headlines section, we look at the sector level forecast for the second quarter earnings period.

Financial Market Update

Dissecting Headlines: Second Quarter Earnings

With the backdrop of trade negotiations and analyzing economic data for clues to potential Federal Reserve policy changes, we have the focus on second quarter earnings reports. The companies in the S&P 500 Index are collectively forecast to see 4.8% year-over-year earnings growth and 4.2% revenue growth.

The overwhelming contribution of the earnings growth to the Index comes from two sectors, the Communication Services sector with a forecast of 29.6% earnings growth for the quarter and the Technology sector with 16.6% growth. Earnings in these sectors is being driven by several factors to include AI infrastructure spending, enterprise digital transformation, cybersecurity, and software and streaming subscription revenue. They are also likely seeing operating leverage as revenue grows above trend.

Four sectors should see positive, but more modest earnings growth. Those are the Utility sector with 4.0% earnings growth for the quarter, Health Care with 3.3% growth, Financials with 2.4% growth, and Real Estate with 1.0% growth.

The remaining five sectors are forecast to see a decline in year-over-year earnings growth for the quarter. These are Industrials at –0.8%, Consumer Staples at –3.3%, Materials at –3.5%, Consumer Discretionary at –5.4%, and Energy at –25.0%.

Key topics that may impact forward projections include the impact of tariffs, interest rates and inflation, staffing levels, and the health of the consumer. Performance and outlook versus expectations should be the major driver of stock prices at the company level.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly July 14, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.