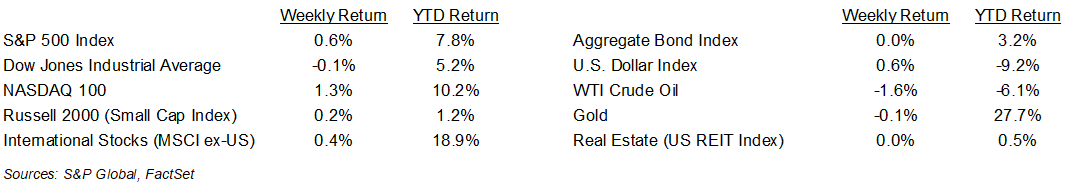

Stocks remained near all-time highs during the first week of the quarterly earnings reporting period. For the week, the S&P 500 Index was +0.6%, the Dow Jones Industrials -0.1%, and the NASDAQ +1.3%. The Technology, Utility, and Industrial sectors led the S&P 500 Index for the week, while the Energy, Health Care, and Materials sectors lagged. The 10-year U.S. Treasury note yield increased to 4.427% at Friday’s close versus 4.419% the previous week.

The June Consumer Price Index (CPI) report showed some creep in inflation with prices +0.3% month-over-month and +2.7% year-over-year. Core CPI, which excludes food and energy prices, was +0.2% month-over-month and +2.9% year-over-year. The June Producer Price Index (PPI) was more subdued with prices flat month-over-month and +2.3% year-over-year. Core PPI, which excludes food, energy, and trade prices, was also flat month-over-month and +2.5% year-over-year. The Federal Reserve is expected to hold interest rates steady at its July 30th meeting. CME Fed funds futures forecast 0.25% rate cuts at the September and December meetings.

The economic data calendar is light this week, so investors focus should be on quarterly earnings reports to take direction. Trade and tariff news is likely to accelerate as we move closer to the August 1st deadline.

The second quarter earnings reporting period ramps up further this week with 112 companies in the S&P 500 Index scheduled to report earnings. Of the 12% of companies that have reported so far, 83% have reported upside results versus consensus expectations. This has increased S&P 500 Index earnings growth expectations for the quarter to 5.6% from 4.8% last week, and revenue growth to 4.4% from 4.2%. Full-year 2025 earnings are expected to grow by 9.3% with revenue growth of 5.1%.

In our Dissecting Headlines section, we look at trends in Back-to-School shopping.

Financial Market Update

Dissecting Headlines: Back-to-School Shopping

Back-to-school shopping is underway, and consumers are expected to spend $128.2 billion on essentials such as clothing, shoes, electronics, and school supplies. This is a 2.2% increase from 2024. K-12 spending is forecast to rise 1.5% and college spending is expected to rise 2.5%.

The survey, conducted by the National Retail Federation and Prosper Insights & Analytics, also showed that more consumers have started their shopping earlier with 67% of survey respondents starting their shopping in early July. More than half of respondents cited fear of prices increases from tariffs as the motivation to start their shopping early. While the majority have started their shopping early, 84% still have more than half their shopping to complete. Reasons cited were still waiting for the best deals, not knowing what items are needed, and the need to spread out spending over a few months to stay within their budgets.

The most popular destinations for back-to-school shopping are online, followed by department stores, discount stores, and clothing stores. Online shopping is driven by promotional activity among the large online players such as Amazon and Walmart. Discount stores have increased share by a few points as stretched budgets prompt bargain shopping. Use of buy now, pay later options have also increased.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly July 21, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.