The Federal Reserve lowered interest rates, the U.S. and China made progress on trade and tariffs, and earnings were generally upbeat from several technology companies. This all led to higher equity markets. For the week, the S&P 500 Index was +0.7%, the Dow Jones Industrials +0.8, and the NASDAQ +2.0%. The Technology, Consumer Discretionary, and Communication Services sectors led the S&P 500 Index, while the Real Estate, Materials, and Consumer Staples sectors lagged. The 10-year U.S. Treasury note yield increased to 4.093% at Friday’s close versus 3.995% the previous week.

The Federal Reserve lowered the Fed funds rate by 0.25% to a 3.75% to 4.00% target range. In the post meeting news conference, Fed Chairman Jerome Powell commented that an additional 0.25% rate cut at the December meeting is still far from certain, citing lack of data to assess the economy due to the government shutdown. CME Fed funds futures are projecting the additional 0.25% cut in December, but probability for a cut in the first quarter of 2026 has been pushed out until April.

A meeting between presidents Trump and Xi produced a U.S. – China trade deal lowering U.S. tariffs on Chinese imports to 47% in exchange for China cracking down on fentanyl precursor chemicals. China also pledged major soybean purchases and agreed to ease export controls on rare earths and magnets for at least one year.

We are past the midpoint of the quarterly earnings reports. This week has 136 companies in the S&P 500 Index scheduled to report results. Third quarter S&P 500 Index earnings growth is forecast at 10.7% with revenue growth of 7.9%. This is a step-up from the 8.0% earnings growth and 6.3% revenue growth for the quarter expected at the start of the earnings period last month. Full-year 2025 earnings are expected to grow by 11.2% with revenue growth of 6.6%.

In our Dissecting Headlines section, we look at specifics on the Federal Reserve policy decision and the U.S.-China trade agreement.

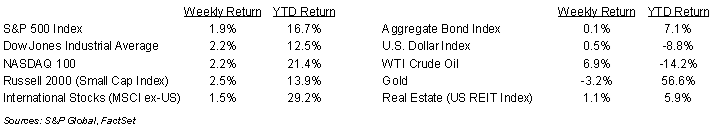

Financial Market Update

Dissecting Headlines: Interest Rates and China Trade

While the Federal Reserve lowered short-term interest rates to a 3.75% to 4.00% target range last week, Fed Chairman Jerome Powell expressed the idea there are still a wide range of outcomes possible for the December meeting and that another 0.25% rate cut is not a sure thing. While the Fed Chairman expressed that he thinks monetary policy is still restrictive to economic growth, the lack of government data creates a level of uncertainty that warrants a slower approach to policy decisions. He used the analogy that when you are driving in fog, you slow down. The committee vote to lower interest rates by 0.25% at the October meeting saw two dissentions, but on opposite sides. There was one vote from Kansas City Fed president Jeffrey Schmid to keep rates steady and one vote from Fed governor Stephen Miran to reduce rates by 0.50%.

Highlights of the U.S.—China trade agreement include China suspending export controls on rare earths, stemming the flow of fentanyl into the U.S. by stopping shipment of precursor chemicals to North America and other parts of the world, and suspending retaliatory tariffs on U.S. goods, mainly agricultural products. China also agreed to purchase at least 12 million metric tons of U.S. soybeans during the last two months of 2025 and at least 25 million metric tons per year from 2026 to 2028. China will also resume purchases of U.S. sorghum and hardwood logs. The U.S. will lower the tariffs on Chinese imports imposed to curb fentanyl flows by removing the 10% penalty tariff, dropping the tariff rate from 57% to 47%. Both sides commented this was a frame work for continued talks, so possibilities for additional actions exist on both sides.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly November 3, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.