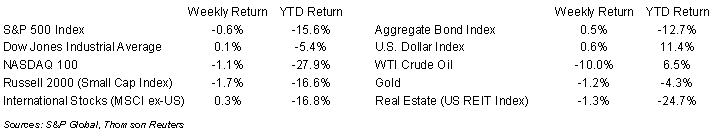

Equity markets consolidated last week after a large advance the week prior. The S&P 500 was -0.6%, the Dow was +0.1%, and the NASDAQ was -1.1%. The 10-year U.S. Treasury note yield decreased to 3.818% at Friday’s close versus 3.893% the previous week.

Following on the heels of the October Consumer Price Index (CPI) report, the October Producer Price Index (PPI) was +0.2% month-to-month and core PPI (excluding food and energy) was also +0.2% month-to-month. Year-over-year, PPI was +8.0% and core PPI was +5.4%. Like the CPI data released the week prior, the data was seen as “cooling inflation”. However, several Fed officials have been making the rounds to remind investors the Fed is not done yet. Fed Governor Christopher Waller indicated he would be open to a 0.50% increase at the December Federal Open Market Committee (FOMC), but that the Fed still has a “ways to go”. St. Louis Fed President James Bullard stated 5.00% to 5.25% is the minimum level he is aiming for on the Fed funds target rate.

The next FOMC meeting is December 13th and 14th. Between now and then, we will see reports on October Personal Consumption Expenditures (PCE) prices (Dec 1st), November employment report (Dec 2nd), November PPI (Dec 9th), and November CPI (Dec 13th).

With 475 companies in the S&P 500 Index having reported third quarter earnings, we are almost complete for the reporting period. This week, 10 companies in the S&P 500 Index are scheduled to report earnings. The current consensus expectation for third quarter is 4.2% earnings growth on 11.6% revenue growth. For CY2022 earnings growth is currently forecast at 5.8% on 11.2% revenue growth.

In our Dissecting Headlines section, we look at Thanksgiving travel and food prices.

Financial Market Update

Dissecting Headlines: Thanksgiving

Even with above-average inflation impacting the cost of just about everything, Americans seem undeterred from traveling and eating this year to celebrate one of the country’s most cherished holidays.

The American Automobile Association (AAA) predicts 54.6 million people will travel 50 miles or more from home this Thanksgiving, up 1.5% from 2021. After depressed travel levels during the COVID-19 pandemic, this year is projected to be the third-busiest Thanksgiving travel season since AAA started tracking it in 2000, with only 2005 and 2019 seeing higher levels of travel. Most travelers will be driving by car, with car travel increasing 0.4% by passenger volume. Air travel is expected to be 7.9% higher by passenger volume. Airline prices are higher as schedules are still reduced by approximately 20%. 1.43 million Americans plan to use other modes of travel to include buses, trains and even cruise ships, for a combined increase of 23.5%. Retail gasoline prices heading into the holiday week are $3.662/gallon, 7.5% higher year-over-year.

At the table, the American Farm Bureau survey shows the average Thanksgiving dinner for 10 people will cost $64.05, 20% higher than 2021 and 37% higher than 2020. A 16-pound turkey costs 21% more year-over-year at $28.96. A 4-pound ham costs 7% more at $11.64. Stuffing costs 69% more than last year and pumpkin pie mix is 18% higher. One item on the Farm Bureau’s survey that is less expensive year-over-year is fresh cranberries which are 14% less expensive, so feel free to have a second helping there.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly November 21, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.