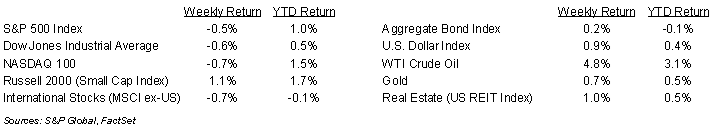

The equity markets ended the last few days of 2024 on a down note but have shown a positive return so far in 2025. For the week, the S&P 500 Index was -0.5%, the Dow Jones Industrials -0.6%, and the NASDAQ -0.7%. The S&P 500 Index was led by the Energy, Utility, and Real Estate sectors, while the Materials, Consumer Discretionary, and Consumer Staples sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.885% at Friday’s close versus 4.903% the previous week.

Mike Johnson was elected as Speaker of the U.S. House of Representatives on Friday, providing some optimism that factions within the Republican Party will not create a dysfunctional process toward working on the new administration’s agenda.

The highlight on this week’s calendar is the Employment Situation Report scheduled for release on Friday. Data on employment and inflation should continue to shape the Federal Reserve’s outlook for monetary policy. Current CME Fed funds futures show the Federal Reserve to pause its interest rate reduction cycle at the January meeting and that a reduction at the March meeting is currently a toss up.

The fourth quarter earnings reporting period begins this week with three companies in the S&P 500 Index scheduled to report earnings. Fourth quarter earnings growth is currently forecast at 11.9% year-over-year with revenue growth of 4.6%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 9.5% with revenue growth of 5.0%. Full-year 2025 earnings are expected to grow by 14.8% with revenue growth of 5.8%.

In our Dissecting Headlines section, we break down the sector level forecast for S&P 500 Index earnings.

Financial Market Update

Dissecting Headlines: S&P 500 Sector Growth

For the fourth quarter of 2024, S&P 500 earnings growth is currently forecast at +11.9%. Data from FactSet shows seven of the eleven sectors are forecast to show year-over-year earnings growth. The Financial sector is expected to have the highest year-over-year growth at +39.5%, followed by the Communication Services sector at +20.7%, and the Technology sector at +14.0%. Rounding out the growing sectors are Consumer Discretionary at +12.8%, Utilities at +12.4%, Health Care at +11.7%, and Real Estate at +6.6%. The four sectors expected to show a decline in year-over-year earnings are the Energy sector at

-24.6%, Industrials at –3.8%, Materials at –2.1%, and Consumer Staples at -1.8%.

Fourth quarter revenue growth for the S&P 500 is currently forecast at +4.6%. The highest revenue growth is expected in the Technology sector at +11.1%, followed by Utilities at +8.0%, and Communication Services at +7.9%. Eight of eleven sectors are forecast to show year-over-year revenue growth. The other five revenue growth sectors are Health Care at +7.5%, Real Estate at +7.2%, Financials at +5.5%, Consumer Discretionary at +4.6%, and Consumer Staples at +1.4%. The three sectors expected to show a decline in year-over-year revenue are the Energy sector at –3.2%, Industrials at –2.4%, and Materials at –0.8%.

The actual earnings results for companies and sectors relative to these expectations, along with their future outlooks, are key determinants of price performance.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly January 6, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.