A deal was struck to avoid a resumption of the partial U.S. government shutdown last week. Macroeconomic Crisis One averted, even though there may be political ramifications of the President’s decision to push ahead with funding the wall for the U.S. southern border through emergency measures. We’re much more concerned about economics, business, and investing, so we’ll pass on any political commentary. Macroeconomic Crisis Two is finding a resolution to the U.S.—China trade dispute as the 90-day ceasefire is set to expire on March 1st. U.S. and China trade representatives are meeting in Washington DC this week and there has been some talk of potentially extending the deadline past March 1st if significant progress is being made in the trade talks.

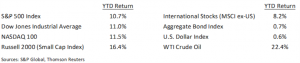

The stock market is pricing in optimism that these crises pass and that any damage on near-term economic and business outcomes will be minor. The S&P 500 and other major stock market indices have continued their advance for the year. Economically sensitive commodities such as crude oil have also been buoyed by optimism. We concur with the optimism that these major concerns that contributed to the market’s steep decline in the 4th quarter of last year eventually get put in the rear view mirror. We also think that the remainder of 2019 sees more volatility than witnessed over the first six weeks of the year as other temporary worries emerge.

Corporate earnings are growing but decelerating. 394 of the companies in the S&P 500 Index have reported earnings and total earnings are 12.9% higher year/year on 7.6% revenue growth. This is a deceleration from the 25.1% earnings growth seen last quarter as the impact of lower corporate tax rates dissipates. We anticipate some continued moderation in growth rates, but no impending forecast of a recession. We continue to advocate for high-quality stocks at this stage in the economic cycle.

Financial Market Update

Dissecting Headlines: Market Capitalization

Stocks come in different sizes. There are Large Cap, Mid Cap, Small Cap and even Micro Cap stocks. This size differentiation is based on Market Capitalization (or “Market Cap”). Market Capitalization is a simple calculation of the value of one share of stock multiplied by the total number of shares the company has issued.

Microsoft, for example, has a current stock price of $108.22. The company has 7.67 billion shares outstanding. Multiplying these, Microsoft’s market capitalization is $830 billion. Microsoft is currently the largest stock in the S&P 500 Index by market capitalization and a “Large Cap” stock. Definitions sometimes vary, but Large Cap stocks are typically over $10 billion, Mid Cap stocks are between $2 billion and $10 billion, and Small Cap stocks are below $2 billion.

A company’s market capitalization can be reflective of dominance within its industry and the world economy. Stock market indices are often designed to classify stocks by size (S&P 500 = Large Cap versus Russell 2000 = Small Cap).

Disclosure: Microsoft is a holding in the NovaPoint Dividend Growth Strategy

Want a printable version of this report? Click here: NovaPoint Feb 18 2019

To learn more about these topics and our investment strategies, contact us today at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.