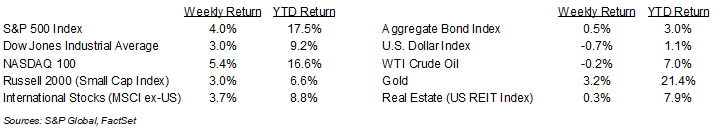

The equity market bounce continued last week. For the week, the S&P 500 was +4.0%, the Dow was +3.0%, and the NASDAQ was +5.4%. Within the S&P 500 Index, the Technology, Consumer Discretionary, and Financial sectors led the market, while the Real Estate, Communication Services, and Utilities sectors lagged. The 10-year U.S. Treasury note yield decreased to 3.888% at Friday’s close versus 3.932% the previous week.

July inflation readings in the Consumer Price Index (CPI) and Producer Price Index (PPI) were in-line with forecasts, leading to investor expectations that the Federal Reserve will lower interest rates at its September meeting. CME Fed funds futures for September imply a 0.25% reduction in the Fed funds rate to a 5.00% – 5.25% target range. Between now and year-end, a total of 1.00% in rate cuts is currently forecast. This week, the minutes of the July Federal Open Market Committee (FOMC) meeting are scheduled for release on Wednesday and Fed Chair Jerome Powell is scheduled to speak at the Jackson Hole Economic Symposium on Friday.

We are 93% done with second quarter earnings reports. Another 14 companies in the S&P 500 Index are scheduled to report earnings this week. For the second quarter, earnings growth is expected be 10.9% higher year-over-year with revenue growth of 5.2%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 10.1% with revenue growth of 5.1%.

In our Dissecting Headlines section, we look at the upcoming Jackson Hole Economic Symposium and the road to the September FOMC meeting.

Financial Market Update

Dissecting Headlines: Jackson Hole

The Jackson Hole Economic Symposium is an annual event held by the Federal Reserve Bank of Kansas City in Jackson Hole, Wyoming. The event brings together economists, financial market participants, academics, U.S. government representatives and news media to discuss long-term policy issues of mutual concern.

The highlight of the meeting is a speech by Chairman of the Federal Reserve, Jerome Powell, who is scheduled to speak on Friday morning. With recent market volatility and a pending rate cut forecast for the September Federal Open Market Committee (FOMC) Meeting, this speech should receive above-average attention.

In a span of two to three months, market expectations have gone from “is a rate cut even necessary” to “the Fed is behind the curve in lowering rates,” so investors will be looking for assurance that the FOMC is on-track to deliver a rate cut at the September meeting.

The next FOMC meeting is September 17-18th. Between now and the meeting, the Committee will be able to evaluate Personal Consumption Expenditures Prices for July on August 30th, the August Employment Situation Report on September 6th, August CPI on September 11th, and August PPI on September 12th.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly August 19, 2024

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.