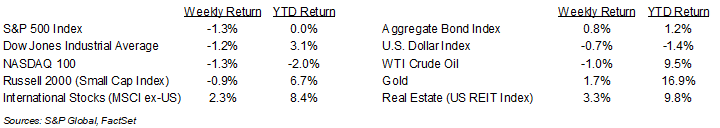

Despite upbeat economic and corporate earnings news, stocks fell for a second consecutive week. For the week, the S&P 500 Index was -1.3%, the Dow Jones Industrials -1.2%, and the NASDAQ -1.3%. The Utility, Real Estate, and Materials sectors led the S&P 500 Index for the week, while the Financials, Communication Services, and Consumer Discretionary sectors lagged. The 10-year U.S. Treasury note yield was 4.051% at Friday’s close versus 4.204% the previous week.

Economic news showed positive signs last week. The January Employment Situation report showed 130,000 net new jobs created versus an expectation of 70,000 and the unemployment rate moving down to 4.3%. The January Consumer Price Index (CPI) showed inflation at +0.2% month-over-month and +2.4% year-over-year, showing a modest disinflationary trend. Core CPI, which excludes food and energy prices, was +0.3% month-over-month and +2.5% year-over-year. The upbeat economic data may have investors thinking a rate cut is less likely in the near-term. CME Fed funds futures show 0.25% reductions forecast for the June and September Federal Reserve policy meetings.

This week 57 companies in the S&P 500 Index scheduled to report earnings. Quarterly earnings are expected to grow by 13.2% and quarterly revenue growth is expected at 9.0%. Full-year 2025 earnings are expected to grow by 13.3% with revenue growth of 7.5% and 2026 full-year earnings are expected to grow by 14.4% with revenue growth of 7.5%.

In our Dissecting Headlines section, we compare recent economic data points to the Federal Reserve’s outlook for the year.

Financial Market Update

Dissecting Headlines: Correlating 2026

Early 2026 economic reports show the U.S. economy on fairly good footing. A weakening labor market seen at the end of 2025 does not look to be accelerating to the downside and inflation continues to grind toward the Federal Reserve’s 2% target level.

At the December Federal Reserve meeting, the Summary of Economic Projections for 2026 forecast the unemployment rate at 4.4% and the January Employment Report showed unemployment at 4.3%. The Fed’s forecast for inflation, as measured by the Personal Consumption Expenditures (CPE) Price Index is 2.4% and Core PCE, which excluded impact of food and energy prices, at 2.5%. The January CPI was 2.4% and Core CPI was 2.5%. Lastly, 2026 economic growth, as measured by Gross Domestic Product (GDP), is forecast at 2.3%, which was an increase from 1.8% prior. The potentially stronger GDP could be a product of a positive consumer spending stimulated by larger than normal income tax refunds due to changes from the One Big Beautiful Bill Act and a positive swing in exports versus imports due to recent tariff and trade negotiations.

We will see an updated 2026 economic forecast from the Federal Reserve at its March policy meeting. Trajectory of the economy, inflation, employment, and the overall feeling of the consumer should be crucial as the year unfolds. February’s consumer becomes November’s voter for the midterm elections.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly February 17, 2026

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.