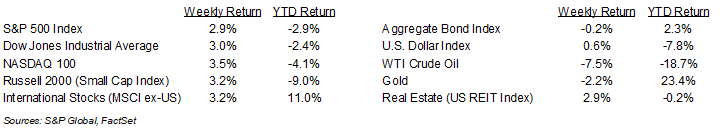

A flurry of economic data created both an air of pessimism and optimism depending on the day. A 0.3% contraction in first quarter Gross Domestic Product (GDP) growth added to recession fears on Wednesday, but a strong jobs report ended the week on a note of optimism. For the week, the S&P 500 Index was +2.9%, the Dow Jones Industrials +3.0%, and the NASDAQ +3.5%. The S&P 500 Index was led by the Industrial, Communication Services, and Technology sectors, while the Energy, Health Care, and Consumer Staples sectors lagged. The 10-year U.S. Treasury note yield increased to 4.308% at Friday’s close versus 4.260% the previous week.

The Federal Reserve’s Federal Open Market Committee (FOMC) meeting is the highlight of the calendar this week. There is no change expected to the current 4.25% to 4.50% Fed funds target range at the meeting, but CME Fed funds futures indicate there could be up to 0.75% in reductions to the Fed funds rate by December, starting at the July meeting. Post-meeting commentary from Fed Chairman Jerome Powell will be important to shaping expectations for monetary policy following last week’s reports on GDP, inflation, and the labor market.

First quarter earnings season continues this week with 92 companies in the S&P 500 Index scheduled to report earnings results. First quarter 2025 earnings growth is currently forecast at 12.8% year-over-year with 4.8% revenue growth. Full-year 2025 earnings are expected to grow by 9.5% with revenue growth of 5.0%.

In our Dissecting Headlines section, we look at the economic reports from last week.

Financial Market Update

Dissecting Headlines: Data Driven

The Federal Reserve has committed to being data driven in its approach to monetary policy. While it is widely expected to keep interest rates steady at the conclusion of this week’s FOMC meeting, there has been much data to absorb and much more on the way over the next few months as the initial policy moves in the first 100 days of the Trump administration start to flow through to the economy. These reports on economic growth, inflation, and employment are important to monetary policy since the Federal Reserve has the dual mandate of price stability and maximum sustainable employment.

The first quarter GDP report showed economic output decreased at a seasonally adjusted annual rate of 0.3% versus consensus forecast of +0.8% and versus +2.4% in the fourth quarter of 2024. The main factor driving lower growth was the high level of growth in imports of 41.3%, which subtracted 5 points from GDP growth. Imports and Exports are netted against each other, so higher net imports is a negative factor. This was likely a pull-ahead of goods in anticipation of the tariffs being enacted. Federal government spending was also 5.1% lower and a large swing from +4.0% growth in government spending in the fourth quarter.

Price stability is expressed through the Fed’s 2% annualized inflation target. The March Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred inflation gauge, showed prices +2.3% year-over-year and core prices, which exclude the impact of food and energy, were +2.6%. There is concern the tariff environment could cause inflation, so the Fed will likely need more data that captures the tariff period before deciding the impact on price stability.

Maximum sustainable employment is measured by the monthly Employment Situation report. The April unemployment rate was steady at 4.2% from March and April showed 177,000 net new jobs created versus an expectation of 130,000.

In the Fed’s quarterly Summary of Economic Projections from March, it indicated 2025 GDP growth could be 1.7%, PCE could be 2.7%, core PCE could be 2.8%, and the unemployment rate could be 4.4%. Under that scenario, the Fed projected a 0.50% decrease in interest rates was an appropriate policy path. Additional data over the next few months should continue to shape the Fed’s monetary policy path.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly May 5, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.