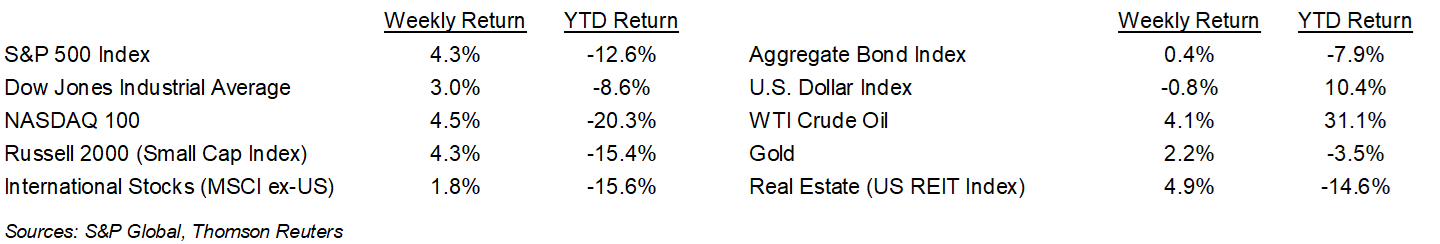

The S&P 500 Index had its first back-to-back weekly gain since the end of March. The S&P 500 Index was +4.3% for the week, the Dow was +3.0%, and the NASDAQ was +4.5%. The 10-year U.S. Treasury note yield decreased to 2.642% at Friday’s close versus 2.781% the previous week.

The market shrugged off a 0.75% Fed funds rate increase, a -0.9% 2Q Advance GDP reading, and an increase in the Personal Consumption Expenditures (PCE) Price Index to rally Wednesday through Friday. Better than expected earnings and outlooks from most companies left investors looking toward the eventual end to Fed rate increases and a return to betting on equities.

For the 279 companies in the S&P 500 Index that have reported earnings for the second quarter, 77.8% have exceeded consensus estimates. The current consensus for second quarter earnings growth is 7.7% on 12.1% revenue growth. This is an upward revision to last week’s consensus of 6.2% earnings growth on 11.3% revenue growth. For full-year 2022 earnings, growth is currently forecast at 8.6% on 11.4% revenue growth. This week 153 companies in the S&P 500 are scheduled to report earnings.

In our Dissecting Headlines section, we look at the major economic events from last week.

Financial Market Update

Dissecting Headlines: A Closer Look at the Economic Data

There were several key economic events last week. The Federal Open Market Committee (FOMC) voted to raise the Fed funds rate by 0.75% to a range of 2.25% to 2.50%. The Fed commented the labor market was steady, inflation was still high, and there are some pockets of economic softening around the economy. The Fed’s balance sheet reduction is in progress with $47.5 billion of treasury and agency securities being runoff per month for June through August, then increasing to $95 billion per month starting in September. There is no FOMC meeting in August, but we will likely hear from multiple Fed officials around the time of the Kanas City Fed’s annual Jackson Hole Economic Symposium from August 25th to 27th. The next scheduled FOMC meeting is September 20th to 21st.

The first reading of Gross Domestic Product (GDP) for the second quarter showed a sequential, annualized decline of 0.9%. While not the final GDP reading, this likely indicates the second consecutive quarterly decline in real GDP. Despite the holistic assessment of a recession that was talked about in the government and media during the week, the consecutive decline in GDP is the technical definition of a recession. This has been a shallow decline, and the cause is not a financial crisis or collapse in consumer spending as has happened in some previous recessions. Personal consumption expenditures were positive. Fixed investment, both commercial and residential, was negative, as was government spending. Net exports were positive. The labor market also remains healthy, which is a key contributor to consumer spending. We will get an update on the labor market when the July employment report is released this coming Friday. The second estimate for GDP for the second quarter, based on more complete data, will be released on August 25th.

The Personal Consumption Expenditures (PCE) Price Index for June was released on Friday. It didn’t have the headline grabbing attention that the FOMC meeting or the GDP release did. Despite an acceleration in prices, it got lost in the earnings news for the day. PCE prices were +6.8% higher year-over-year and, ex food and energy, prices were +4.8% year-over-year. At the June FOMC meeting, the FOMC’s economic projections were targeting core PCE to fall to 4.3% by year-end.

________________________________________

Want a printable version of this report? Click here: NovaPoint August 1, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.