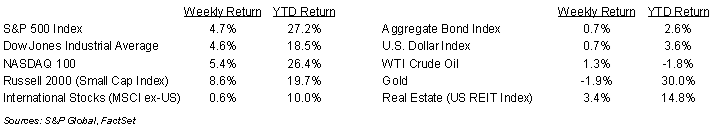

Equity markets rose sharply after the results of the U.S. elections. Equity markets had their best week of the year with the S&P 500 +4.7%, the Dow +4.6%, and the NASDAQ +5.4%. All eleven sectors in the S&P 500 Index were positive for the week. The Consumer Discretionary, Energy, and Industrial sectors posted the strongest advances, while the Consumer Staples, Utility, and Material sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.288% at Friday’s close versus 4.375% the previous week.

Donald Trump was victorious in the Presidential election and the Republican Party gained control of the U.S. Senate. The race for control of the U.S. House of Representatives is still undecided. The Republicans have a strong lead in seats won but haven’t yet secured a 218 seat majority.

Following the election, the November Federal Open Market Committee (FOMC) lowered the Fed funds rate by 0.25% at its November meeting, bringing the Fed funds rate to a 4.50% to 4.75% target range. Current CME Fed funds futures show an additional 0.25% reduction predicted for the December FOMC meeting.

We are 90% of the way through the third quarter earnings reporting period. Reports continue this week with 12 companies in the S&P 500 Index scheduled to release results. Third quarter earnings growth is currently forecast at 5.3% year-over-year with revenue growth of 5.5%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 9.4% with revenue growth of 5.1%.

In our Dissecting Headlines section, we look at the election results.

Financial Market Update

Dissecting Headlines: Election Results

Donald Trump won the U.S. Presidential election. Despite some speculation the race could takes several days to decide, Trump had enough races called to achieve more than 270 electoral votes before the market opened on Wednesday morning.

The market rallied Wednesday to Friday, most likely due to the certainty that the election brought by having a winner decided quickly, and the prospect that a Trump administration currently favors lower corporate tax rates and a rollback of many regulations that are currently unfavorable to businesses.

The market reaction also tells us that investors believe a Republican sweep is likely to get a greater part of the president-elect’s agenda turned into reality. The Republican Party will take control of the U.S. Senate with a majority of 53 seats with one Senate race still undecided in Arizona. The Republican Party leads so far in the House of Representatives with 214 seats but needs an additional 4 seats to retain control.

Between now and inauguration day on January 20th there should be a steady stream of announcements regarding policy initiatives, cabinet appointments, and other news from the new administration that could influence both markets in general and specific industries. Following inauguration day, we will see how well policy is implemented and its corresponding impact on businesses, consumers, and investors.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly November 11, 2024

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.