Equity markets closed higher for the week with the S&P 500 Index +1.7%, the NASDAQ +2.7% and the Dow +1.1%. The U.S. 10-year Treasury bond yield decreased to 1.431% at Friday’s close versus 1.524% the previous week.

The June employment report was the major news story ahead of the Independence Day holiday weekend. The labor market added 850,000 jobs in June, ahead of the consensus forecast of around 700,000. The hospitality sector continued to be the main driver of job growth with 343,000 of the net new jobs created. The labor market is still seven million jobs below the February 2020 level just prior to the start of the pandemic.

Initial unemployment claims for the week of June 26th decreased to 364,000 versus the previous week at 415,000. Continuing claims for June 19th were 3.469 million versus 3.390 million the week prior. The slack that still exists in the labor market appears to be the last obstacle to a full economic recovery from the pandemic.

Ahead of the start of second quarter earnings, the current expectation is for S&P 500 earnings growth of 65.4%. Cyclical sectors, especially those hit hard by COVID-19 a year ago, are poised to see the largest year-over-year earnings increases. Industrials, Consumer Discretionary, Energy, Materials, and Financials are all forecasted to see >100% earnings growth for the quarter.

In our Dissecting Headlines section, we take a closer look at the June employment report.

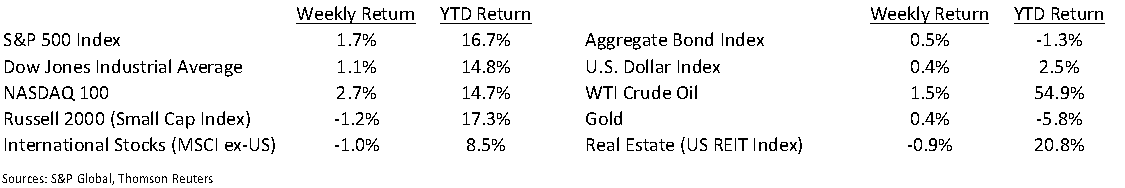

Financial Market Update

Dissecting Headlines: Employment Report

Growth of 850,000 jobs in June was the bright spot in the employment report. There were a few other points in the report we found interesting.

First, why did the unemployment rate increase to 5.9% versus 5.8% in May if there were 850,000 new jobs created? The data comes from two different surveys. The job growth data comes from the Establishment Survey, while the unemployment rate is calculated from the Household Survey. These surveys can sometimes misalign, but do tend to be consistent over time. The labor force participation rate can also impact the calculation of the unemployment rate, but it was consistent month-to-month at 61.6%.

Second, there have been several news articles on the topic of people quitting their jobs rather than return to the office post-COVID. We can see this in the data where 942,000 people voluntarily left their jobs in June. People normally quit their jobs when they have good confidence of finding another job or already have one lined up.

Third, from the Establishment Survey, we mentioned above that the hospitality sector saw the best growth with 343,000 new jobs. Other sectors that contributed meaningfully to job growth were Professional and business services (+72,000), retail (+67,100), and education and health services (+59,000). Meanwhile, the automobile (-12,300) and construction (-7,000) industries lost jobs during the month.

The employment situation is likely to continue to see shifts over the next few months as the lingering impact of the pandemic’s economic disruption settles out.

________________________________________

Want a printable version of this report? Click here: NovaPoint July 6, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.