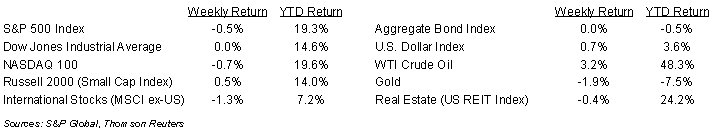

The equity markets continued their slow downward move last week. The S&P 500 Index closed the week –0.5%, the NASDAQ –0.7% and the Dow was flat. Small capitalization stocks and oil bucked the trend. The U.S. 10-year Treasury bond yield increased to 1.363% at Friday’s close versus 1.343% the previous week.

Nine companies in the S&P 500 Index that are on the front end of the third quarter reporting cycle are scheduled to report earnings this week. The heart of the quarterly earnings season won’t start until October. The current forecast for third quarter earnings for the S&P 500 Index is +29.5%. The main driver of the market over the next few weeks is likely to be the macroeconomic impacts of the spending bills currently in Congress and the impact of any announcements from the Federal Reserve regarding its economic outlook and eventual taper of monthly bond purchases.

Initial unemployment claims for the week of September 11th increased to 332,000 versus the previous week at 312,000. Continuing claims for September 4th were 2.665 million versus 2.852 million the week prior. More sustainable progress on job growth is likely to be a key topic for the Federal Reserve meeting this week.

In our Dissecting Headlines section, we look at the upcoming Federal Reserve meeting.

Financial Market Update

Dissecting Headlines: Upcoming Federal Reserve Meeting

The Federal Reserve’s Federal Open Market Committee (FOMC) meets this Tuesday and Wednesday. While we expect them to keep the Fed Funds target interest rate at 0% to 0.25%, there are a few other items that bear watching for this meeting.

For meetings that occur on the quarter-end months, in this case September, the FOMC releases economic projections for GDP growth, the unemployment rate, inflation, and what each member believes the appropriate Fed Funds rate should be.

The “assessment of appropriate monetary policy”, also known as the “dot plot” gives clues as to when policy on short-term interest rates may change. At the last quarterly meeting in June, the 2023 median projection for short-term rates increased from 0.1% to 0.6% for 2023. This was an explicit shift that rates would likely start going up in late 2022 to early 2023.

The projections for GDP growth may also be worth a look. The current debate around the infrastructure plan, budget, debt ceiling, and COVID measure could swing projections for economic growth at this meeting or the December quarterly.

The biggest question for the FOMC currently is when will the tapering of monthly bond purchases begin and how quickly will the Fed move through the process. Prior to the August employment report and with momentum behind the spending bills, it was likely the tapering of bond purchases could begin in October. Several Fed officials were out “jawboning” to that course of action. With a poor showing for job growth in August and the opposition to the large spending bills, there is a chance this action could be pushed out by a month or two. Either way, it is very likely a taper is completed before the first half of 2022.

________________________________________

Want a printable version of this report? Click here: NovaPoint September 20, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.