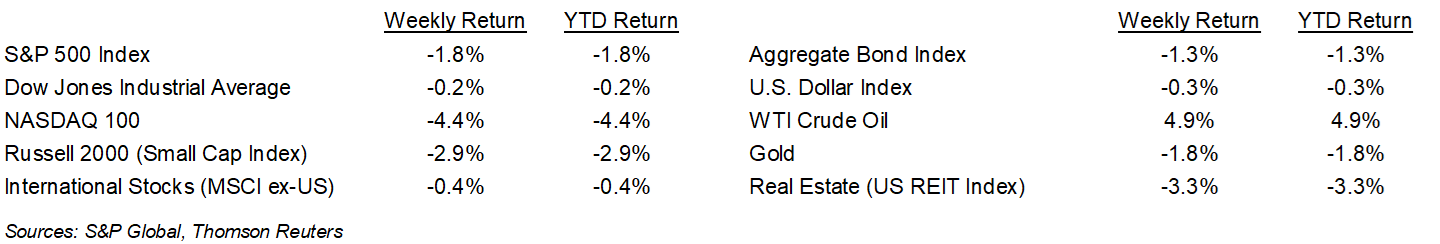

The equity markets struggled the first week of the new year after the minutes from the December Federal Reserve meeting, which were released this past Wednesday, indicated the Fed could potentially accelerate its actions to slow bond buying, raise short-term rates, and shrink its balance sheet. The news sent equities down for the week and interest rates higher. The S&P 500 Index ended the week -1.8%, the Dow was +0.2%, and the NASDAQ was -4.4%. The U.S. 10-year Treasury bond yield increased to 1.766% at Friday’s close versus 1.512% the previous week.

Nonfarm payrolls rose by 199,000 in December, below the consensus estimate of 422,000. This is the second consecutive month of job growth below expectations. The unemployment rate was 3.9% versus 4.2% in November. In a continuation of the re-opening trend, the leisure and hospitality sector saw the best job gains for the month.

A few companies begin fourth quarter 2021 earnings reporting this week and that tempo will increase over the next few weeks. Heading into the start of the reporting season, 4Q21 earnings are expected to grow 22.4% on 12.1% revenue growth.

In our Dissecting Headlines section, we look at the December Federal Reserve meeting minutes.

Financial Market Update

Dissecting Headlines: December Fed Meeting Minutes

In the quarterly summary of economic projections released in December, the Federal Reserve laid out a good road map for its actions for 2022. It would accelerate the tapering of the monthly bond buying program and have the program completed by the end of the first quarter of the year. It would also raise short-term interest rates three times at 0.25% each. This is a normalization of the previous accommodative policy put in place in the early days of the pandemic.

This past Wednesday, the minutes of the December Federal Reserve meeting indicated Fed officials could accelerate its actions even further. Not only would it complete the taper and start raising short-term interest rates as soon as March, but it would also start unwinding its $8.8 trillion balance sheet. Much of the treasury bonds and mortgage-backed securities on the Fed balance sheet have been accumulated during the pandemic.

This swifter call to action caused interest rates to increase. The ten-year treasury bond ended the week at a yield of 1.766%, up from 1.512% the week prior.

The Fed appears to be responding more to the problematic inflation trends than its other focus of full-employment. As mentioned above, job growth has underperformed expectations the past two months. We will likely learn more in a few weeks following the January 25th—26th Federal Reserve meeting.

________________________________________

Want a printable version of this report? Click here: NovaPoint January 10, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.