Confirmation from the Federal Reserve that the economy has reached a level improvement that allows a reduction in COVID-era policy accommodation rallied the S&P 500 Index to all-time highs last week. The S&P 500 finished the week +2.0%, the Dow was +1.4% and the NASDAQ was +3.2%. The U.S. 10-year Treasury bond yield decreased to 1.451% at Friday’s close versus 1.554% the previous week.

Current quarterly forecast for the S&P 500 Index is for earnings to be +41.5% year-over-year versus an expectation of +39.2% last week. At the outset of the earnings season in early October, the third quarter year-over-year growth was expected to be 29.4%. This week 13 companies in the S&P 500 are scheduled to report earnings.

As expected, the Federal Reserve laid out its framework for reducing monthly bond purchases (a.k.a “the Taper”) that should last into mid-2022. At that point, the Fed can address the Fed Funds target rate depending on factors such as employment and inflation.

Initial unemployment claims for the week of October 30th decreased to 269,000 versus the previous week at 283,000. Continuing claims for October 23rd were 2.105 million versus 2.239 million the week prior. The October employment report supported the Fed’s move to begin the Taper with 531,000 new jobs created for the month and the unemployment rate dropping to 4.6%.

In our Dissecting Headlines section, we review the Fed’s current game plan with the Taper.

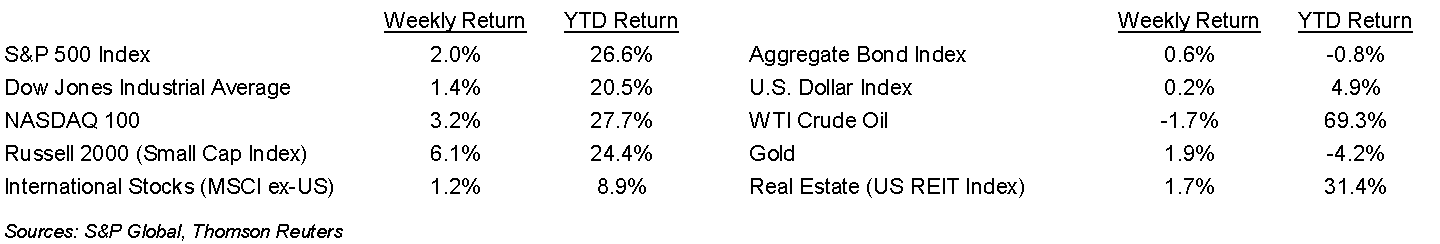

Financial Market Update

Dissecting Headlines: Taper Time

The Fed announced the beginning of a reduction in its monthly asset purchases (a.k.a. “the Taper”). Since the start of the pandemic, the Fed has been buying $80 billion in Treasury Bonds and $40 billion in housing-backed securities each month. The Fed announced that in mid November and December it will reduce the amount of Treasury securities purchases by $10 billion and mortgage-backed securities by $5 billion. It expects to continue that pace in the months ahead. It should phase out the bond buys completely by next June. At that point, the Fed can consider an adjustment to the Fed Funds target rate which is currently at 0% to 0.25%.

This announcement was based on the economy meeting the criteria to remove the excess liquidity. Inflation, as we have seen, is above the long-term target rate of 2% and employment has been improving, even if it has been lumpy in its recovery. The October employment report showed 531,000 new jobs created and the employment rate dropping to 4.6%. This provided investors with sufficient evidence the Fed’s plan to retract its accommodative policy stance was inline with what is happening in the economy without causing any disruption.

Based on the progress of the Taper, we would expect an initial increase in the Fed Funds rate some time in the third quarter of 2022. Depending on where the economic data progresses from here, we may see speculation for the Fed to adjust the pace of the taper and/or alter its potential timeline for changes in the Fed Funds target rate.

________________________________________

Want a printable version of this report? Click here: NovaPoint November 8, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.