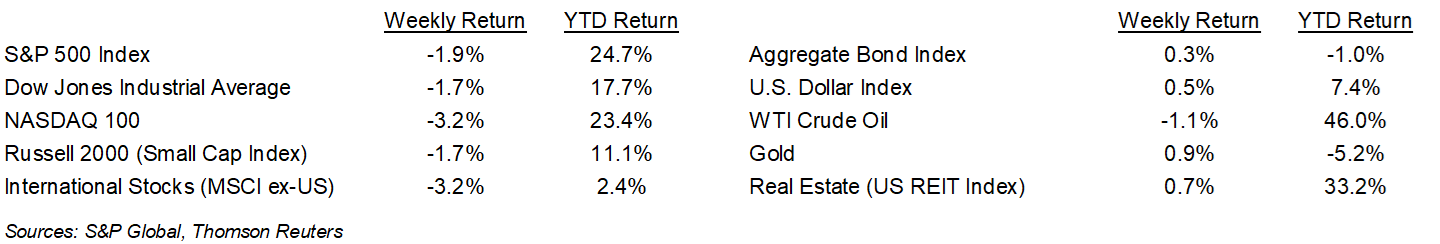

The Federal Reserve meeting provided a roadmap for 2022 monetary policy which we think was favorably received by the markets, however, concern surrounding the omicron variant returned following increases in positive testing across several countries. The net effect had the S&P 500 Index lower for the week by -1.9%, the Dow was -1.7% and the NASDAQ was -3.2%. The U.S. 10-year Treasury bond yield decreased to 1.407% at Friday’s close versus 1.482% the previous week.

On again, off again concerns regarding the potential impact of the omicron variant have whipsawed markets over the past few weeks. Early indications from South Africa that the omicron severity in patients has been mild gives us confidence there should not be lasting negative impact to the economy.

Senator Joe Manchin’s announcement he will not support the current Build Back Better spending plan puts approximately $1.75 trillion of government spending on hold.

Looking ahead, fourth quarter earnings are expected to grow 22.2% on 11.9% revenue growth. This is a slight increase from the 22.0% growth forecasted last week.

In our Dissecting Headlines section, we look at some details from the recent Federal Reserve meeting.

Financial Market Update

Dissecting Headlines: Federal Reserve Meeting Review

Two key mandates for the Federal Reserve are employment and price stability. When the economy locked down in early 2020 due to the COVID pandemic, the Fed acted quickly by reducing short-term interest rates to near zero and providing financial liquidity by purchasing government and mortgage bonds in the open market.

Now that the economy has largely recovered from the impact of the pandemic and inflation has been on the rise, the Fed is beginning to reduce its accommodative policy stance. At last week’s Federal Open Market Committee (FOMC) meeting, the committee indicated the Fed’s 2022 plans are to increase the Fed funds target rate from its current 0% to 0.25% range, up to a 0.75% to 1.00% range. This would likely be accomplished by three individual increases of 0.25% over the course of the year.

The Fed has also started slowing the level of bonds it purchases each month and now plans to accelerate that reduction (or “tapering”) to complete its program by the end of the first quarter of 2022. Previously, we had anticipated the bond tapering could last through mid-2022. Once the tapering has been completed, the Fed can assess the current economic situation and the FOMC can vote on changes in short-term interest rates.

This change in policy has been clearly communicated and can be supported by evidence of improvement in employment and rising prices.

________________________________________

Want a printable version of this report? Click here: NovaPoint December 20, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.