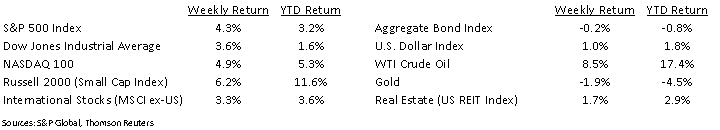

Positive quarterly earnings reports and progress on stimulus talks helped the equity market rebound to start February on a positive note. The Dow Jones Industrial Average was +3.6%, the S&P 500 Index was +4.3%, and the NASDAQ 100 Index was +4.9%.

We’re just past halfway in the fourth quarter earnings cycle and S&P 500 Index earnings are now expected to be positive for the quarter. Fourth quarter earnings are expected to increase 2.4% year-over-year versus a 1.6% decline as of last week and an expectation of a 10.6% decline a month ago. Quarterly revenue is expected to increase 1.1% year-over-year versus a 0.2% increase last week and a 1.4% decline a month ago. Much of the difference versus initial expectations has come in the consumer discretionary, energy, and financial sectors.

Of the 286 companies in the S&P 500 that have reported QTD, 83.6% have reported earnings above consensus. This week, another 82 companies in the S&P 500 are scheduled to report earnings. Full-year 2020 earnings are expected to decline 12.3% y/y and full-year 2021 earnings are expected to rise 23.5% y/y.

Initial unemployment claims during the week of January 30th declined to 779,000 versus 812,000 the previous week. Continuing claims for the week of January 23rd were 4.592 million versus 4.785 million the week prior. The January Employment Report showed non-farm payrolls increasing by 49,000 and the unemployment rate at 6.3%

In our Dissecting Headlines section, we look at the yield curve.

Financial Market Update

Dissecting Headlines: Yield Curve

Interest rates, whether for savings (bank accounts, CDs, bonds) or borrowing (mortgages, car loans, credit cards), are all set at some relative spread to government interest rates at various points in time. When all the interest rates for U.S. Government notes and bonds are plotted on a graph by years-to-maturity, they make a curved line known as the Yield Curve.

The earlier maturities, at three-months or one-year, impact interest rates for banks accounts and credit cards. The middle part of the curve, at two-years to five-years, impact bonds and CDs at those maturity dates and intermediate term debt such as car loans. The longer part of the curve, at 10-years to 30-years, impacts longer term bonds and mortgages.

The interest rate announcements from the Federal Reserve impact short-term interest rates and economic factors, while the fixed income market impacts long-term rates. The Federal Reserve has pledged to keep short-term interest rates low until a full economic recovery from COVID-19 has been achieved. The fixed income market has started to anticipate this recovery and interest rates at the 10-year point have increased 0.26% year to date to 1.19%.

__________________________________________________________

Want a printable version of this report? Click here: NovaPoint February 8, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.