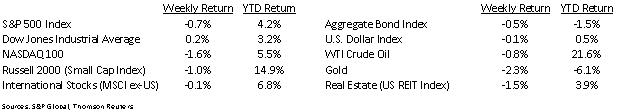

The equity market advance froze this week along with most of the country. The Dow Jones Industrial Average was +0.2%, the S&P 500 Index was –0.7%, and the NASDAQ 100 Index was –1.6%.

With 399 companies in the S&P 500 Index having reported fourth quarter earnings, 81.7% have reported earnings above consensus. Continuing the trends since the earnings reporting started, the outlook for the fourth quarter results has continued to inch up. Fourth quarter earnings are expected to increase 3.7% year-over-year versus an expectation of a 3.4% increase as of last week and an expectation of a 10.6% decline a month ago. Quarterly revenue is expected to increase 1.2% year-over-year versus a 1.3% increase last week and a 1.4% decline a month ago. Full-year 2020 earnings are expected to decline 12.0% year-over-year and full-year 2021 earnings are expected to rise 23.3% year-over-year. This week, another 66 companies in the S&P 500 are scheduled to report earnings.

The employment situation has gotten lumpier. Initial unemployment claims for the week of February 13th were 861,000 versus the previous week at 848,000. Continuing Claims for February were 4.494 million versus 4.558 million the week prior. Continued improvement in employment is a key factor to a lasting economic recovery.

In our Dissecting Headlines section, we look at the potential economic impact of the recent winter storms.

Financial Market Update

Dissecting Headlines: Winter Storm Impact

Winter weather is an annual event, but the breadth of the storms this past week into areas of the country not accustomed to or typically not equipped for severe weather was a rare occurrence. The event is likely to have some visible but temporary impact when February economic data is analyzed.

AccuWeather estimates the economic impact of the storms to be in the $45 to $50 billion range. This includes damage to homes and businesses, as well as their contents, job and wage losses, infrastructure damage, medical expenses and cost of closures. To put the dollar figure into perspective, the economic impact of 2020’s hurricane season, which was severe, was in the $60 to $65 billion range.

Based on data from the National Oceanic and Atmospheric Administration (NOAA), the combination of all the winter storms and freezes between 1980 and 2020 cost a total of $80.8 billion, on an inflation-adjusted basis. If this 2021 storm hits the forecasted $45 to $50 billion mark, it should be a significant, severe outlier.

Some economic losses in February should be made up in March and subsequent months as home and commercial repairs are made, as well as planned business and consumer spending that was delayed during the storm.

__________________________________________________________

Want a printable version of this report? Click here: NovaPoint February 22, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.