The first quarter earnings season is underway. Several of the large banks reported at the end of last week. This week we will hear from a larger and more diversified group of companies. This should keep the focus on individual company fundamentals for the next few weeks leading up to the next Federal Open Market Committee (FOMC) monetary policy meeting on May 3rd.

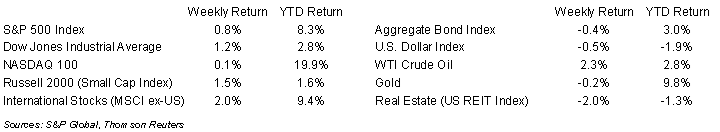

The S&P 500 Index ended the week +0.8%, the Dow was +1.2%, and the NASDAQ was +0.1%. The 10-year U.S. Treasury note yield increased to 3.522% at Friday’s close versus 3.383% the previous week.

The March Consumer Price Index (CPI) and Producer Price Index (PPI) reports showed a continued, gradual cooling of inflationary pressure in the economy. The CPI was +0.1% month-to-month and core CPI, which excludes food and energy prices, was +0.4% month-to-month. Year-over-year, CPI was +5.0% and core CPI was +5.6%. The PPI was -0.1% month-to-month and core PPI was +0.2% month-to-month. Year-over-year, PPI was +4.6% and core PPI was +4.4%.

First quarter earnings reporting continues this week. For the first quarter, the S&P 500 Index is expected to see earnings decline 4.8% on revenue growth of 1.7%. For full year 2023, S&P 500 Index earnings are expected to grow 0.6% on revenue growth of 1.6%.

In our Dissecting Headlines section, we look at several categories in the recent CPI report.

Financial Market Update

Dissecting Headlines: Consumer Prices

While the recent CPI and PPI indicate that the upward surge in inflation has likely peaked, it does not mean that prices are falling. The rate of inflation is decreasing and the Federal Reserve is trying to steer prices back to a more palatable 2% annual increase.

Looking inside the CPI report, food prices were flat month-to-month in March, but still 8.5% higher year-over-year. Energy prices have declined 3.5% month-to-month and 6.4% year over year. More visible to consumers, gasoline prices declined 4.6% month-to-month and are 17.4% lower year-over-year. Prices at the pump have increased so far in April following the increase in oil prices after the recent OPEC+ announced production cuts. New vehicle prices were +0.4% month-to-month and are 5.6% higher year-over-year. Used vehicle prices, however, declined 0.9% month-to-month and are 11.5% lower year-over-year. Shelter (housing) costs remain high with a 0.6% month-to-month increase and are 8.2% higher year-over-year.

Overall consumer prices remain higher on a year-over-year basis. This is intentional as the Federal Reserve has stated that demand destruction is necessary to lower prices. This impact can be seen in the recent retail sales report. March retail sales declined 1.0% month-to-month and were 2.9% higher year-over-year. Sales declined month-to-month and year-over-year at auto dealers, furniture stores, electronics and appliance stores, building materials and garden stores, gasoline stations (mainly due to lower prices), clothing stores, and department stores.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly April 17, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.