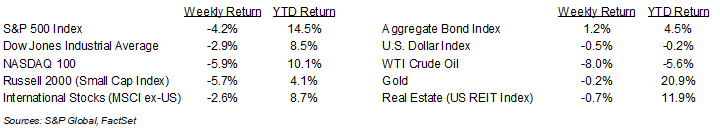

September started with downside pressure in the equity markets. For the week, the S&P 500 was -4.2%, the Dow was -2.9%, and the NASDAQ was -5.9%. Within the S&P 500 Index, Consumer Staples and Real Estate were the only two positive sectors for the week. The worst performing sectors were Technology, Energy, and Communication Services. The 10-year U.S. Treasury note yield decreased to 3.717% at Friday’s close versus 3.918% the previous week.

The August Employment Situation report showed 142,000 net new jobs created versus an expectation of 165,000. Both June and July job creation was revised down. The August unemployment rate decreased to 4.2% from 4.3% in July. The labor market needs to find a balance where there is enough slack to keep wage inflation from pushing overall inflation, but strong enough to keep consumers employed to avoid a recession. The Federal Reserve’s focus has been shifting from fighting inflation to supporting the labor market. Based on CME Fed funds futures, investors currently see a 0.25% reduction to the fed funds target rate to a 5.00% to 5.25% range at the September Federal Open Market Committee (FOMC) meeting and a total of 1.00% in cumulative reductions by year-end.

We are about a month away from the start of the third quarter earnings reporting period. Third quarter earnings growth is currently forecast at 4.9% year-over-year with revenue growth of 4.8%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 10.1% with revenue growth of 5.4%.

In our Dissecting Headlines section, we look at the Federal Reserve’s dual mandate.

Financial Market Update

Dissecting Headlines: Dual Mandate

John Williams, president of the New York Federal Reserve Bank, stated last week that it is now appropriate to dial down the degree of restrictiveness in monetary policy by reducing the fed funds rate. His comments were based on his view that the two parts of the Federal Reserve’s mandate, price stability and maximum employment, had come into “equipoise’, or a point of equilibrium.

With the decline in the rate of inflation, several Federal Reserve officials have expressed confidence that it is on a sustainable path toward its 2% annualized goal. The Personal Consumption Expenditures (PCE) Price Index averaged over 6% higher year-over-year in the first quarter of 2022 when the Fed made its initial increase to the fed funds rate to a 0.25% to 0.50% target range to start curbing the rate of inflation. By the end of 2022, the fed funds rate rose to a 4.25% to 4.50% target range and the December PCE Price Index had decreased to 5.4%. The most recent PCE Price Index report for July was 2.5%.

Now that we are in better balance with the rate of inflation declining, the Fed can focus on reducing restrictiveness to stem further deterioration in the labor market. Current unemployment stands at 4.2% and the Fed would like to return that figure below 4%. As mentioned above, a balanced labor market provides strong consumer confidence and consumer spending while not contributing to excessive labor inflation. Working Americans combined with lower interest rates can provide a healthy level of GDP growth without returning to a period of excessive price growth.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly September 9, 2024

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.