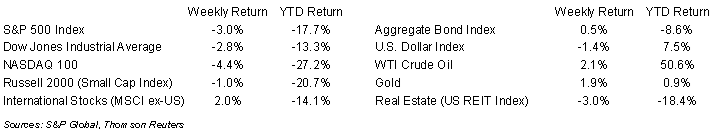

The S&P 500 Index rallied back from an intra-day decline on Friday that had the Index temporarily down 20% from its peak. The S&P 500 ended the week -3.0%, the Dow was -2.8%, and the NASDAQ was -4.4%. The equity markets have declined for seven consecutive weeks amid concerns over the impact of rising interest rates and inflation. The 10-year U.S. Treasury note yield decreased to 2.788% at Friday’s close versus 2.928% the previous week.

Two key economic releases for this week are the Minutes of the May Federal Open Market Committee (FOMC) meeting due on Wednesday and the April Personal Consumption Expenditures Price Index (PCE) on Friday. The PCE index is meaningful because it is the FOMC’s preferred gauge for measuring inflation.

Two Federal Reserve Bank presidents supported Chairman Jerome Powell’s plan for 0.50% increases at the next two FOMC meetings. Chicago Fed President Charles Evans endorsed the two 0.50% rate increase and wants to move fast to get to a neutral level on the Fed funds rate, which he sees at 2.25% to 2.50%. Once at a neutral rate, Evans thinks the Fed can scale the rate hikes down to 0.25% and see where the inflation and the economy develop. Evans thinks the economy can head into 2023 at a PCE level below 3%. Meanwhile, St. Louis Fed President James Bullard supported the front-loading strategy and believes the Fed funds rate should get to 3.5% by the end of the year. He also said that once inflation is under control, he wouldn’t rule out that policy could ease in 2023 or 2024. Bullard also commented the likelihood of a recession is low. He believes the economy will growth with GDP of 2.5% to 3.0% and the unemployment rate possibly falling below 3% by year end. Growth is likely to be supported by strong consumption as Americans start to travel and experience more following the pandemic.

Several major retailers disappointed on earnings reports last week, adding anxiety to views of how the consumer is handling the higher inflationary and interest rate environment. The current consensus for 1Q22 remained at 11.1% earnings growth on 13.8% revenue growth versus 6.1% earnings growth on 10.9% revenue growth at the start of the earnings season. For the 474 companies in the S&P 500 that have already reported first quarter earnings, 77.6% have reported earnings above analyst estimates. This coming week 15 companies in the S&P 500 Index are scheduled to report earnings.

In our Dissecting Headlines section, we look at the forecast for Memorial Day Travel.

Financial Market Update

Dissecting Headlines: Memorial Day Travel

A higher number of travelers will be hitting the road, rails and skies this Memorial Day weekend. The Automobile Association of America (AAA) predicts 39.2 million people will travel 50 miles or more from home this holiday weekend, an increase of 8.3% over 2021. Air travel (3.01 million travelers) is expected to be +25% over last year. Bus, train, and cruise travel (1.33 million travelers) is expected to be +200%. Auto travel (34.9 million travelers) is expected to be +4.5%.

This increase comes as travelers are expected to weather higher prices year-over-year. Retail gasoline prices are averaging $4.596/gallon, +50% year-over-year. Airlines ticket prices are more than 6% higher year-over-year. Hotels prices have increased 42% year-over-year. The one bright spot is that car rental prices have declined 16% year-over-year.

Consumer spending on goods and services, to include travel, makes up approximately two-thirds of the economy, so a consumer willing to stretch their legs and their wallet to travel is a positive benefit to growth.

________________________________________

Want a printable version of this report? Click here: NovaPoint May 23, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.