Lots of positives stacked up this past week with the Fed lowering short-term interest rates by 0.25%, a stronger than expected employment report, and continued progress on U.S. – China trade. These along with good third quarter earnings reports pushed the S&P 500 into record territory.

The Federal Reserve lowered its short-term target rate by 0.25% to a 1.50% to 1.75% range. This is the third interest rate reduction of the year and, in our view, probably the last that is needed unless economic conditions worsen. The interest rate announcement was followed later in the week by a better than expected employment report for October. With low interest rates and strong employment, the U.S. is experiencing what is sometimes referred to as a “Goldilocks Economy”. This is explained below on our Dissecting Headlines section.

Of the 356 companies that have reported 3Q earnings, 76% have exceeded expectations, 8% have met expectations and 17% have reported below expectations. Current expectation is for a 0.8% decline in year/year earnings on 3.7% revenue growth versus last week’s consensus of a 2.0% earnings decline on a 3.4% increase in revenue. For the coming week, 88 companies in the S&P 500 are scheduled to report earnings.

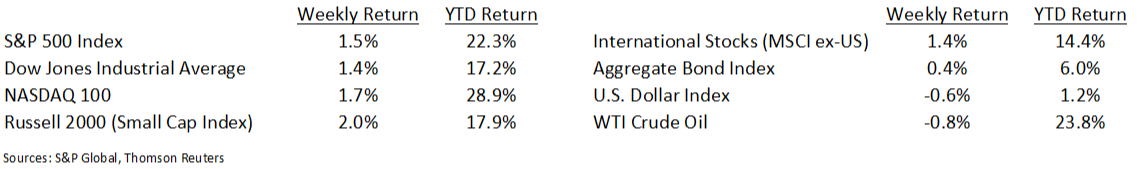

Financial Market Update

Dissecting Headlines: Goldilocks Economy

You may have seen some financial headlines this past week referring to a “Goldilocks Economy”. Similar to the fairytale when Goldilocks tastes the porridge in the bear’s house, the baby bear’s porridge wasn’t too hot and it wasn’t too cold, it was “just right”. This reference is carried over as a metaphor for the economy when economic conditions aren’t so hot that inflation and rising interest rates are a worry, but also that growth is not anemic where one would worry about an imminent recession. The economy is just right.

This is the U.S. economy now. Inflation remains contained and the Federal Reserve has been accommodative on monetary policy. Employment is at record levels and, despite some weakness in the manufacturing sector (perhaps due to U.S.—China trade issues), GDP growth has been good.

The worry, of course, is what happens when the bears come home. For now, that does not appear to be an immediate concern, but we are always on the look out.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint November 4, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.