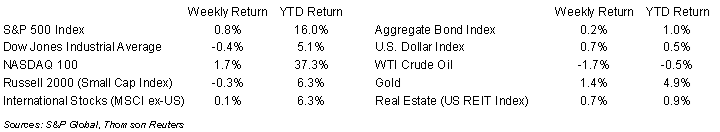

Stocks were mixed last week as the corporate earnings season winds down and Fed Chairman Jerome Powell held the line on being steadfast on inflation in his remarks at Jackson Hole. The weekly return for the S&P 500 Index was +0.8%, the Dow was -0.4%, and the NASDAQ was +1.7%. The Technology and Consumer Discretionary sectors led the market. The Energy and Consumer Staples sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.239% at Friday’s close versus 4.251% the previous week.

Fed Chairman Jerome Powell stated that the Fed is prepared to raise interest rates further if appropriate and intends to hold policy at a restrictive level until the Federal Reserve is confident that inflation is moving sustainably down. He has not deviated from the 2% annualized inflation target. Current Fed funds futures point to a 78.5% probability the Federal Open Market Committee (FOMC) will keep rates unchanged at the September meeting, down from an 88.5% probability a week ago.

The second quarter earnings period is almost complete with 485 companies in the S&P 500 Index having reported. This week, another 12 companies are scheduled to report earnings. Second quarter earnings expectation for the S&P 500 Index is a 3.0% year-over-year earnings decline on a revenue increase of 0.5%. Current consensus for full year 2023 earnings is an increase of 2.2% on revenue growth of 2.0%. Both the second quarter and full-year outlook have increased since earnings reporting started in early July.

In our Dissecting Headlines section, we look at important data points to monitor between now and the September FOMC meeting.

Financial Market Update

Dissecting Headlines: Economic Data Points

One element of Federal Reserve decision making on monetary policy that Jerome Powell has stressed is being data dependent. Between now and the September 19th-20th FOMC meeting, there are several economic data points that can better inform the voting members of the FOMC, and investors, about the appropriate path for interest rates.

This week, the July Personal Consumption Expenditures (PCE) Price Index is scheduled for release on Thursday. This is the index the Federal Reserve benchmarks its inflation target on. The 2% annualized inflation target is core inflation (excludes food and energy) as measured by the PCE. Also this week is the August Employment report from the Department of Labor. Chairman Powell expects unemployment to rise, so continued strong employment data could contribute to the decision for additional interest rate increases between now and year-end.

The week of September 11th, reports for retail and wholesale inflation for August are scheduled for release. The Consumer Price Index (CPI) report is scheduled for September 13th and the Producer Price Index (PPI) is scheduled for September 14th. Continued moderation in the rate of inflation is essential to the FOMC considering a pause at the September meeting.

While the FOMC may not have substantial interest rate increases ahead relative to the large increases seen over the past year, the final fine tuning of interest rates will eventually lead to a discussion of how long short-term interest rates remain at elevated levels. That answer likely will also be data dependent as we move through the remainder of the year and into 2024.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly August 28, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.