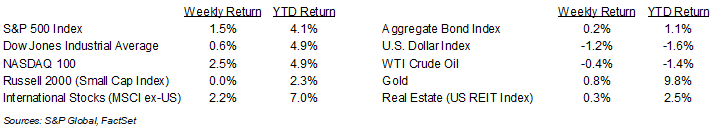

Equity markets rebounded last week as investors continue to absorb new information on the economy, government spending, and proposed tariffs at rapid speed. For the week, the S&P 500 Index was +1.5%, the Dow Jones Industrials +0.6%, and the NASDAQ +2.5%. The S&P 500 Index was led by the Technology, Communication Services, and Consumer Staples sectors, while the Health Care, Financials, and Industrials sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.476% at Friday’s close versus 4.488% the previous week.

Progress on inflation did not make any significant strides in January. The January Consumer Price Index (CPI) was +0.5% month-over-month and +3.0% year-over-year. Core CPI, which excludes food and energy prices, was +0.4% month-over-month and +3.3% year-over-year. The January Producer Price Index (PPI) was +0.4% month-over-month and +3.5% year-over-year. Core PPI, which excludes food, energy, and trade prices, was +0.3% month-over-month and +3.4% year-over-year. At his testimony to Congress last week, Fed Chair Jerome Powell kept a consistent message of the Fed being patient. Much of what could impact monetary policy this year is yet to be determined until a budget plan is passed by Congress. CME Fed funds futures reflect the Fed’s patient stance with no rate cuts seen until July.

We continue the downslope of the fourth quarter earnings reporting period with 46 companies in the S&P 500 Index scheduled to report earnings this coming week. Fourth quarter earnings growth is currently forecast at 16.9% year-over-year with revenue growth of 5.2%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 10.2% with revenue growth of 5.2%. Full-year 2025 earnings are expected to grow by 12.7% with revenue growth of 5.5%.

In our Dissecting Headlines section, we look at a roundup of tariff news.

Financial Market Update

Dissecting Headlines: Tariff Roundup

The initial tariff announcements from the Trump administration were 10% across the board on China and 25% on Canada and Mexico. The Canada and Mexico tariffs are currently on hold for 30 days after the two countries agreed to strengthen border security to stop the flow of illegal immigration and fentanyl.

The 25% steel and aluminum tariffs were announced second and those are scheduled to go into effect on March 12th. Those seem purely economic in design. They go into effect for all countries as of now, to include Canada and Mexico. Canada is the largest supplier of both aluminum and steel to the United States. The UAE, South Korea, Bahrain, and China round out the aluminum top five and Brazil, Mexico, South Korea, and German round out the steel top five.

The Trump administration is also exploring reciprocal tariffs on countries where there are tariffs being placed on U.S. goods. These are designed to exactly match existing tariffs, no more or no less. The administration is scheduled to announce decisions by April 1st. These are designed to level the playing field with countries where the administration feels unilateral tariffs and other financial methods are responsible for U.S. trade deficits with each country. The trade partners where the U.S. has the largest trade deficits are China, Mexico, Vietnam, Ireland, and Germany.

As we have seen so far, the tariff announcements have been designed to speed trade negotiations and get quick concessions from trade partners. We will have a better idea of the outcomes when the Canada and Mexico 30-day period expires in early March, and then at the March 12th steel and aluminum implementation, and the reciprocal tariff plan at the start of April.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly February 18, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.